In a way we never would have thought 30 years ago, personal data is now a currency, incredibly valuable to advertisers, brands, and scammers alike. The recent events with the leaking of our personal data held by the HSE and various other data security issues across the state have brought this issue into clear focus. Our ownership of our personal data is protected by GDPR, while the death of 3rd party cookies and the general increase in protecting individual data has promised to revolutionise advertising.

So how protective are we of our personal data and how secure is that data?

Collection of personal data

The majority of Irish adults regularly use platforms that collect personal data, While usage and ownership of smart devices skew younger, acceptance of cookies skews older.

- 72% of us regularly use social media

- 69% usually accept ALL cookies on a website

- 63% own smart home devices

- 37% regularly sign up to websites to access content

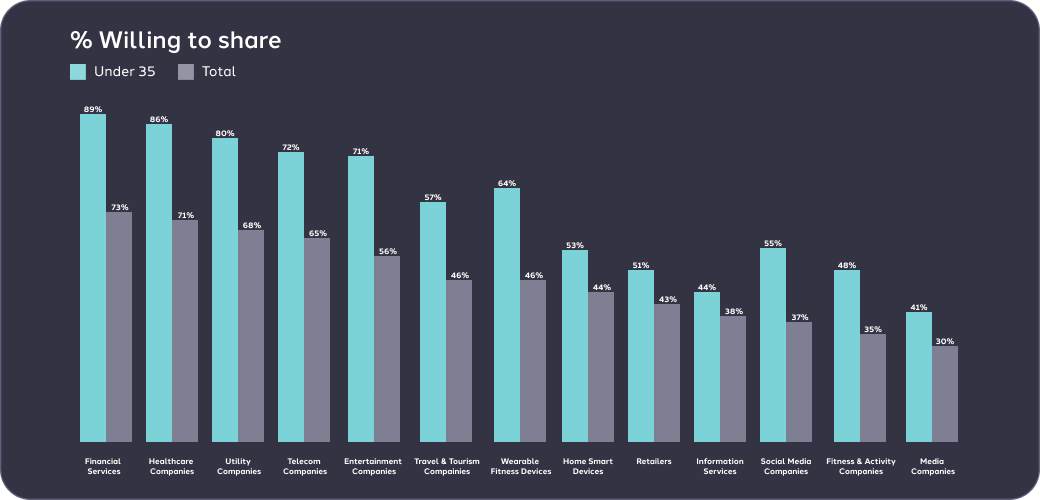

However, there is a transactional approach to sharing our personal details – we are most likely to be willing to share personal data with banks, healthcare companies, and utilities (this research was carried out before the HSE data leak issue, so we can assume this will have changed).

We are least likely to want to share them with social media companies, fitness companies or media companies. Only 1 in 6 (16%) said they were happy to share with all of these industries although nearly a quarter (24%) of under 35s were happy to share.

While willingness to share data depends on the industry, people tend not to mind companies using their data if they can see a benefit but rarely find it helpful. Companies keeping personal details to autofill details or to receive an emailed receipt are uses of data that consumers see as most helpful. People are most likely to accept giving their personal details for loyalty programmes.

The use of personal data for ‘personalised advertising’ is seen as helpful by a tiny minority whereas nearly half are uncomfortable with it or find it unacceptable. However, many more people are happy for their details to be used for personalised products or services, rewards, or birthday discounts.

What we are asked to share matters

We are most likely to share our gender, first name, and email address when asked but few people will share their income. Phone numbers and home addresses are situation-dependent so are more likely to provided when necessary rather than volunteered.

People are also becoming warier of how much of their personal information that they share and are taking active steps to protect their personal data. Three in five people (59%) regularly use payment services to protect their financial details and 24% sometimes do. However, only 32% have ever used a disposable payment card. 81% clear their cookie and browser history at least sometimes.

Only a quarter of people have ever used false or temporary names/email addresses.

What does this mean?

Irish people are practical in their approach to sharing personal details. As a brand or service you need to show the value to consumers of sharing their personal details with you and many people is open to customised deals based on their previous use of your product or service. Brands need to take care in how consumers' details are used and be sure to be adding real value.

Brands should also be mindful of how much personal data is being asked for. There is a comfort level with sharing gender, first name and email address, but when data that is more sensitive is requested, such as income, trust can be impacted.

Younger people (under 35 years) are more likely to use products and services which collect personal data. They are more willing to share personal data than their older counterparts but engage in more protective strategies online like using anonymous browsers, fake email addresses, or turning off cookies.

Download our full report for more

For more details and to hear more contact:

| Dael Wood | Claire O’Rourke |

| Strategic Consulting Director | Research Lead, Dentsu Consult |

| Dael.wood@dentsu.com | Claire.orourke@dentsu.com |