In Indonesia, despite global economic uncertainty, there is remarkable resilience, with GDP growth in the fourth quarter of 2023 increasing to 5.04 percent. This growth is higher than the average GDP growth in Southeast Asia (SEA) of 4%. Year-on-year (YoY) inflation in December 2023 in Indonesia was 2.61 percent, lower than the average inflation rate in SEA countries of 3%. BCG forecasts a promising future, with rising incomes expected to fuel consumption, particularly within Indonesia, where the middle class, comprising around 80 million people, plays a pivotal role. McKinsey's insights suggest that as incomes rise, opportunities in the Consumer Packed Goods (CPG) market expand, driven by premiumisation and societal shifts towards healthier, more sustainable products.

However, amidst SEA's economic growth, challenges continue to lurk, including inflationary pressures and supply chain disruptions highlighted by the OECD (Organisation for Economic Co-operation and Development). While consumer price inflation in SEA remains low relative to the rest of the world, consumers are still impacted by the rising cost of living and inflationary pressures. However, amidst these challenges lie opportunities for innovation and adaptation, as brands and consumers navigate the evolving market landscape, poised on the brink of transformation.

A recent report from dentsu, "The SEA Retail Evolution CPG" offers in-depth insights into consumer dynamics in Indonesia and other Southeast Asian countries, and their evolving preferences in the retail sector.

Consumer sentiment: A tale of concern and resilience

Delving into the psyche of SEA consumers, the report unveils a rich tapestry of emotions interwoven with economic apprehensions. While concerns over the economy, climate change, and unemployment echo throughout the region, Indonesian consumers, in particular, express a heightened sensitivity towards job security.

Mirroring this sentiment, the data demonstrates that across different generations in Indonesia, there is a consistent pursuit of reassurance, security, and positivity, reflecting a shared desire for stability amid uncertain times. Gen Z seeks these reassurances, while Gen Y yearns for positivity alongside security and inspiration. Similarly, Gen X and Boomers echo these sentiments, highlighting a collective aspiration for hope and resilience amidst economic challenges. Nonetheless, amidst these uncertainties, prevailing sentiments of gratitude, hopefulness, and calm underscore the innate resilience ingrained within the population.

Adapting shopping behaviours in times of uncertainty

Amidst economic uncertainty, consumers across Southeast Asia demonstrate a tendency towards pragmatic spending habits. Notably, in Indonesia, in an average month, consumers allocate 43% of their income to groceries. This figure is the highest compared to other Southeast Asian countries which is less than 30%. Therefore, many opt for cheaper grocery alternatives and embrace cost-saving measures such as cooking meals at home. Lifestyle adjustments, such as reducing dining out and cutting non-essential expenditures, reflect a conscientious effort to navigate the prevailing economic landscape.

When it comes to purchasing decisions, Indonesian consumers, akin to their regional counterparts, prioritize quality, price, and convenience. Notably, quality emerges as the paramount attribute driving purchase choices, underscoring consumers' discerning preferences amidst a myriad of options.

Furthermore, there exist numerous factors influencing consumers' emphasis on trust in a brand prior to purchase. In Indonesia and other SEA countries, consumers place significant importance on reliability, credibility, and customer-first when acquiring retail or packaged food and beverage items. Reliability is the foundation of trust in a digital economy. News of poor service or product flaws can be shared globally in an instant. Amid industry disruption and change, an established brand heritage remains a key driver of trust. Consumers today are more concerned about brands’ responsiveness and putting their interests first (Responsiveness to feedback and Consumer First) than how close a brand is to them. Some consumers also demand transparency and genuine commitment to progressive values towards society and the environment

The rising influence of new sources and platforms

Going multi-platform allows brands to target their customers across various channels such as social media, websites, mobile apps. The reality we face as marketers today is that our customers are seeking information and inspiration across multiple platforms - traditional and digital. This approach ensures that a brand message reaches a wider audience and increases the likelihood of customer engagement.

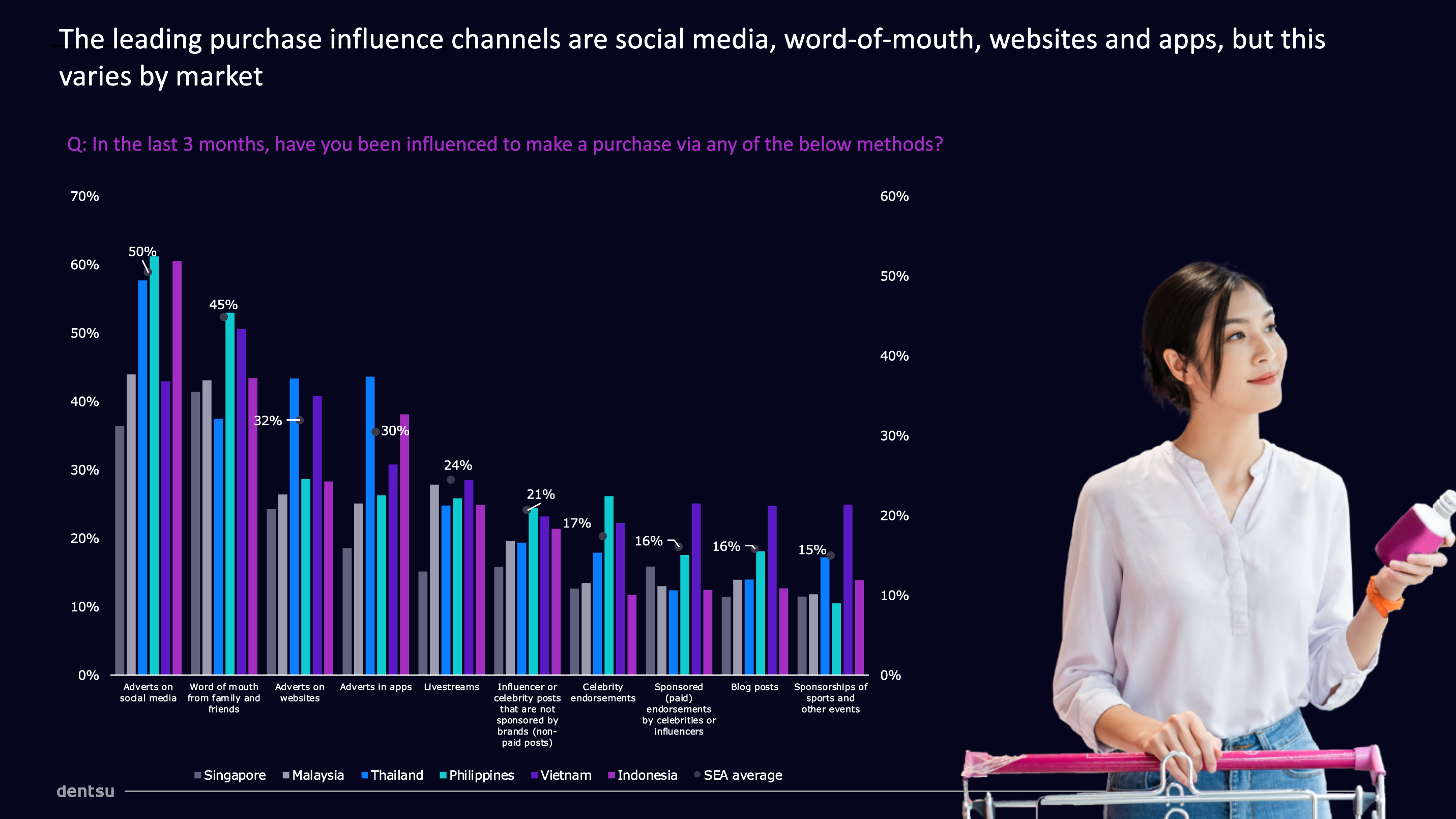

As depicted in the chart, a plethora of channels, platforms, or sources influence the purchase decision. The leading channels of influence include social media, word-of-mouth, websites, and apps, but this varies by market. What this means, specifically for CPG brands in internet mature countries such as Indonesia is that it is increasingly important to include social media advertising, live-streaming, and influencer/KOLs as part of your marketing mix.

It is also worth noting that in the evolving media landscape, KOLs are transforming from content creators to influential media platforms, leveraging AI to automate tasks and expand their global reach. As their influence grows, KOLs are becoming key incubators of future talent and are increasingly monetising their platforms through direct-to-fan economy features, effectively becoming autonomous media powerhouses.

Equally important will be the continued rise of gaming, retail media, and new ad-supported formats as rich sources of engagement and influence in driving commerce. According to Statista's Global Video Game Users 2027 report, there are over three billion gamers worldwide tuned into virtual landscapes. Additionally, with a market projected to be worth $320 billion by 2026, as indicated by a PwC report, advertisers are increasingly interested in tapping into gaming as a media channel.

In addition to the exploration of the evolution of CPG retail in Indonesia mentioned above, the CPG Retail SEA Evolution report also explains four key trends that offer further contextual understanding of the CPG market in Indonesia and other Southeast Asian countries. Discover our comprehensive analysis of the CPG retail evolution in SEA, encompassing Indonesia, and unlock the roadmap to success by harnessing emerging trends and consumer sentiment to cultivate enduring brand-consumer connections in the dynamic markets of tomorrow. Access the CPG Retail Evolution report for insightful guidance.