Christmas 2025: How Irish Consumers Are Spending This Festive Season

As we wrap up 2025, dentsu’s sixth Pulse Wave surveyed 1,000 Irish adults to uncover how cost-of-living pressures, shopping habits, and payment preferences are shaping Christmas spending. Here’s what we found - and what it means for brands.

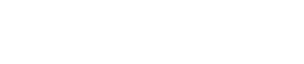

Cost-of-Living Concerns Are Easing, but Still Present

Two-thirds of Irish adults remain quite or extremely concerned about rising living costs, though this marks a steady year-on-year decline. Concern is highest among women and those aged 45–54, signalling that while financial caution persists, confidence is slowly returning. This reflects ongoing cost-of-living concerns that shape festive budgets.

Spending Intentions: Holding Steady, With Some Cuts

Nearly half of consumers plan to spend about the same as last year across most categories. However, discretionary areas like clothing, sports equipment, and beauty continue to see the sharpest declines. Gift buying remains restrained: 42% expect to buy fewer gifts, and 39% plan to spend less. Despite this, alcohol and experience gifts have seen a slight uptick compared to 2024. These insights highlight Irish consumer spending 2025 patterns, showing cautious optimism.

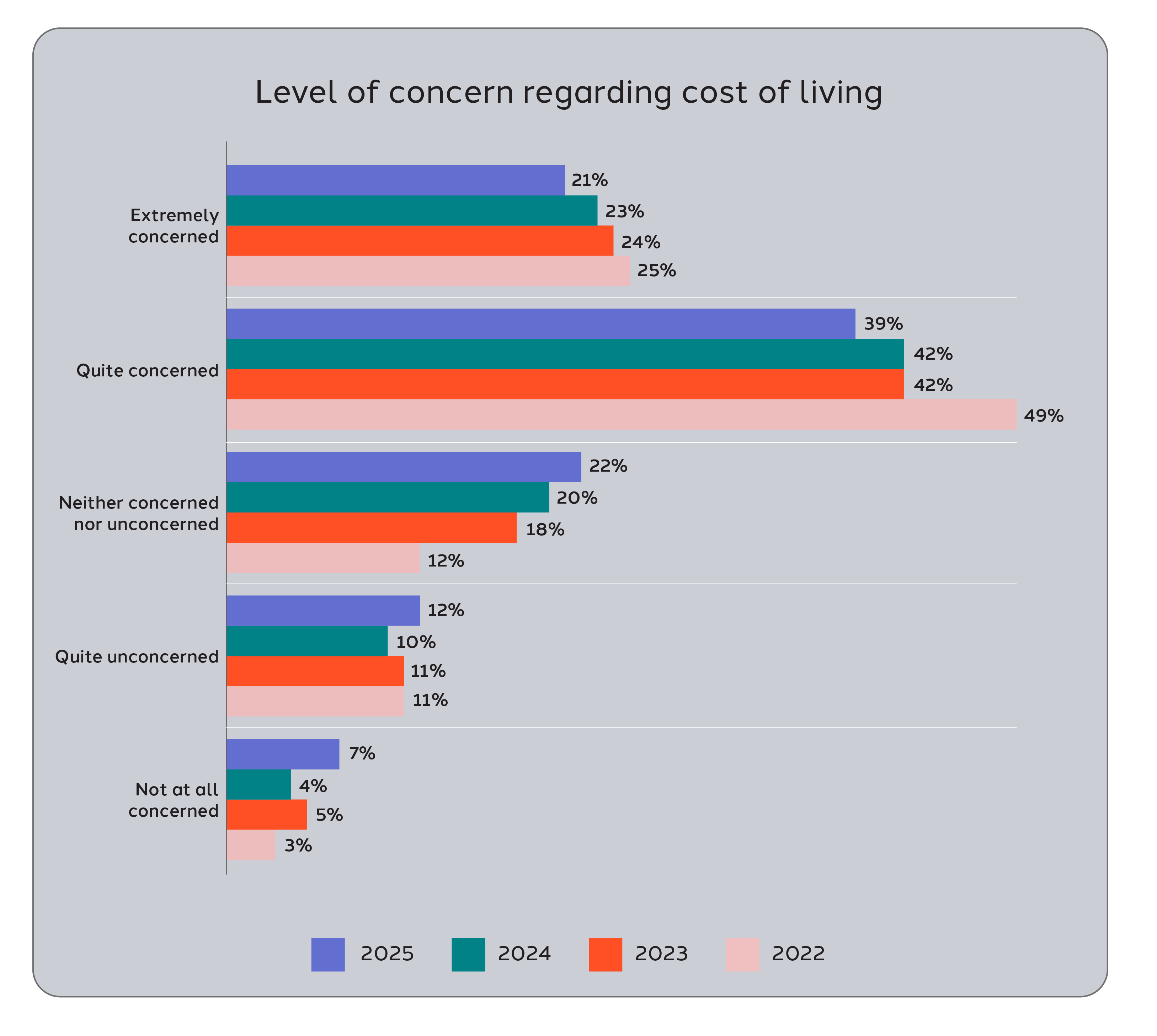

Online Shopping Surge

Digital continues to dominate festive shopping. Furniture leads the shift, with online purchases jumping from 17% in 2024 to 40% in 2025. This trend underscores the importance of seamless e-commerce experiences and omnichannel strategies for brands. The rise of online shopping in Ireland underscores the need for strong e-commerce strategies.

Payment Preferences Are Changing

Irish consumers are diversifying how they pay: Credit cards and personal loans are on the rise, Buy-now-pay-later options appeal strongly to younger adults (23% of 25–34s), and Debit card and cash use is declining. This signals a growing appetite for flexible payment solutions, especially among younger cohorts. Flexible options like buy-now-pay-later Ireland are gaining traction among younger shoppers.

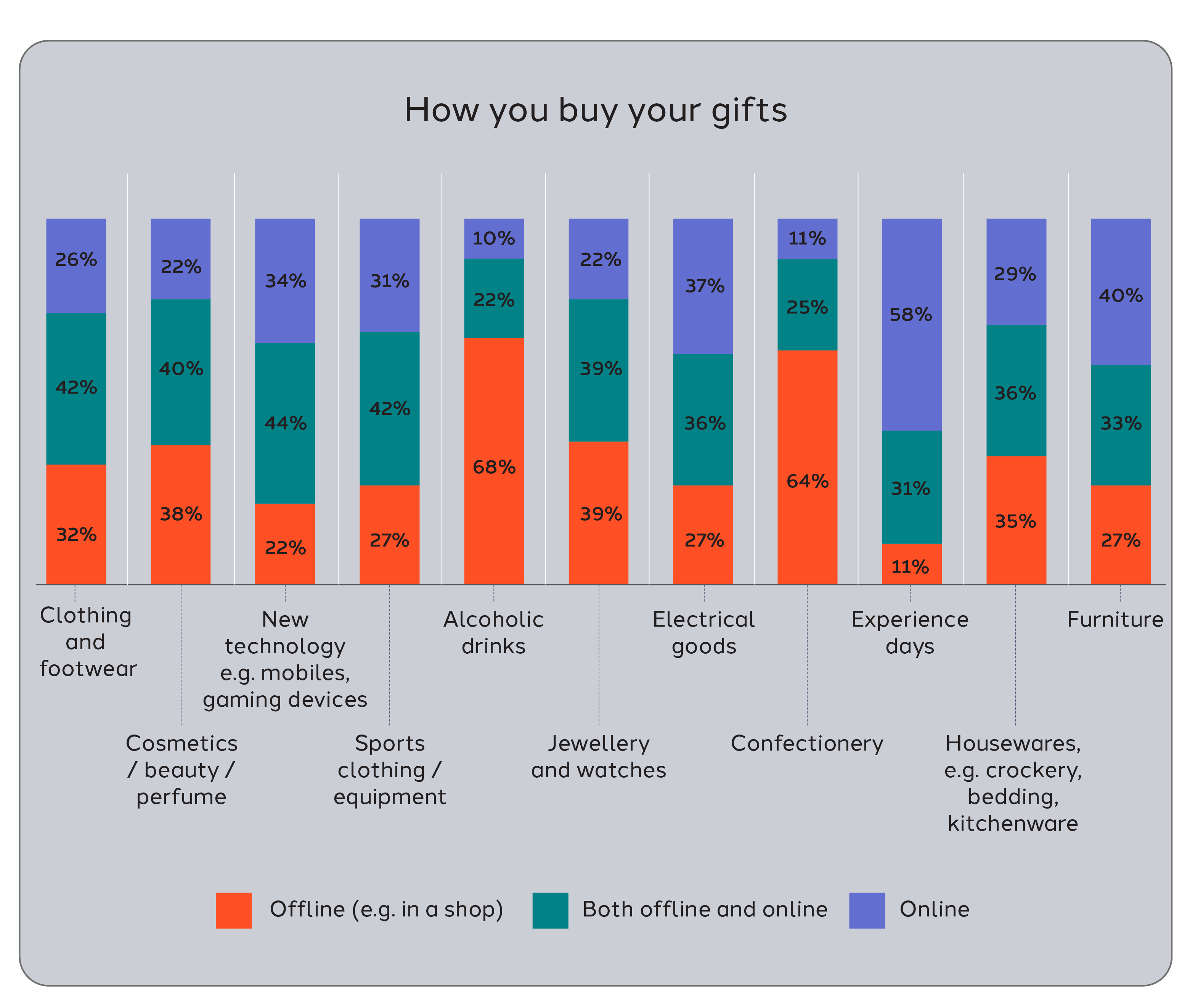

Local Love: Irish Products Still Win

Support for local remains strong. Many consumers intend to buy Irish across food, non-alcoholic drinks, and Christmas gifts, presenting a clear opportunity for brands that emphasise provenance and authenticity. Irish brands' Christmas remain a top choice for consumers seeking authenticity and local pride.

What Does This Mean for Brands?

Irish consumers are entering Christmas 2025 with cautious optimism. While cost-of-living concerns linger, spending stability and the rise of online shopping create fertile ground for brands that: Demonstrate value in discretionary categories, Invest in digital experiences and flexible payment options, and Highlight Irish provenance to tap into local pride. Brands that align with these trends can build trust and relevance during the festive season—and beyond.

Want deeper insights? Download the full Pulse Wave 6 Report here

For more insights and information about the research, contact:

Zsofi Toth, Research and Insights Director, dentsu Ireland.