China ad spend growth holds steady at 3.9%

- Ad spend growth for China in 2020 is forecast at 3.9%, slightly up from 3% actual growth in 2019. The impact of coronavirus epidemic pulls down Q1 activity, but government measures to support economic growth and consumer confidence, as well as the Tokyo 2020 Olympics provide a positive boost to the second half of the year. Due to the continued global impact of COVID-19, especially on events, forecasts for 2020 are subject to change and estimations will be adjusted accordingly.

Global

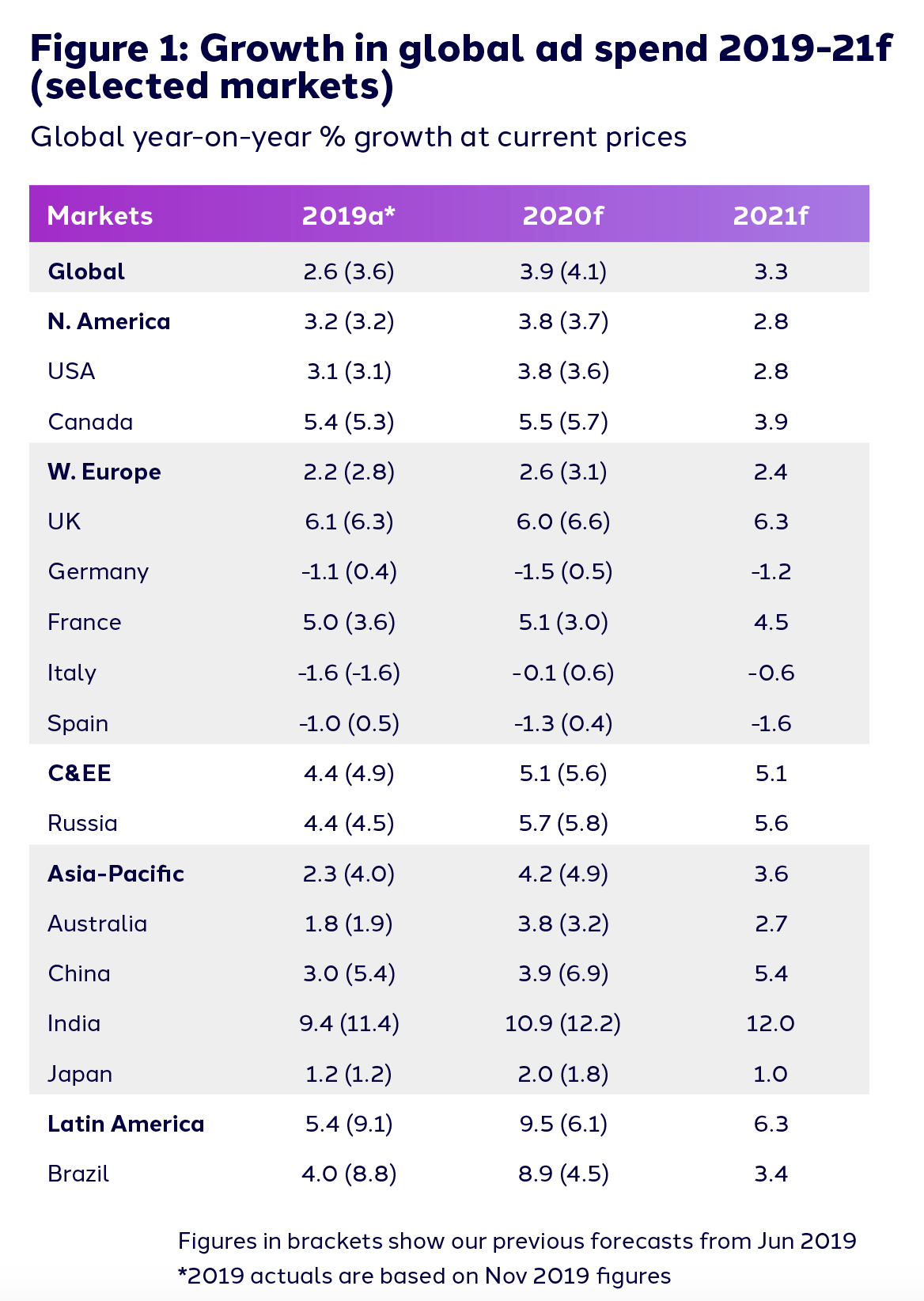

- Global events boost ad spend growth to 3.9% in 2020, up from 2.6% in 2019 but this may change depending on the continued impact of the COVID-19 epidemic.

- Underlying trends paint a more nuanced picture with emerging economies in APAC and Latin America powering growth, while some developed markets will see declining growth as risk of recession gains momentum.

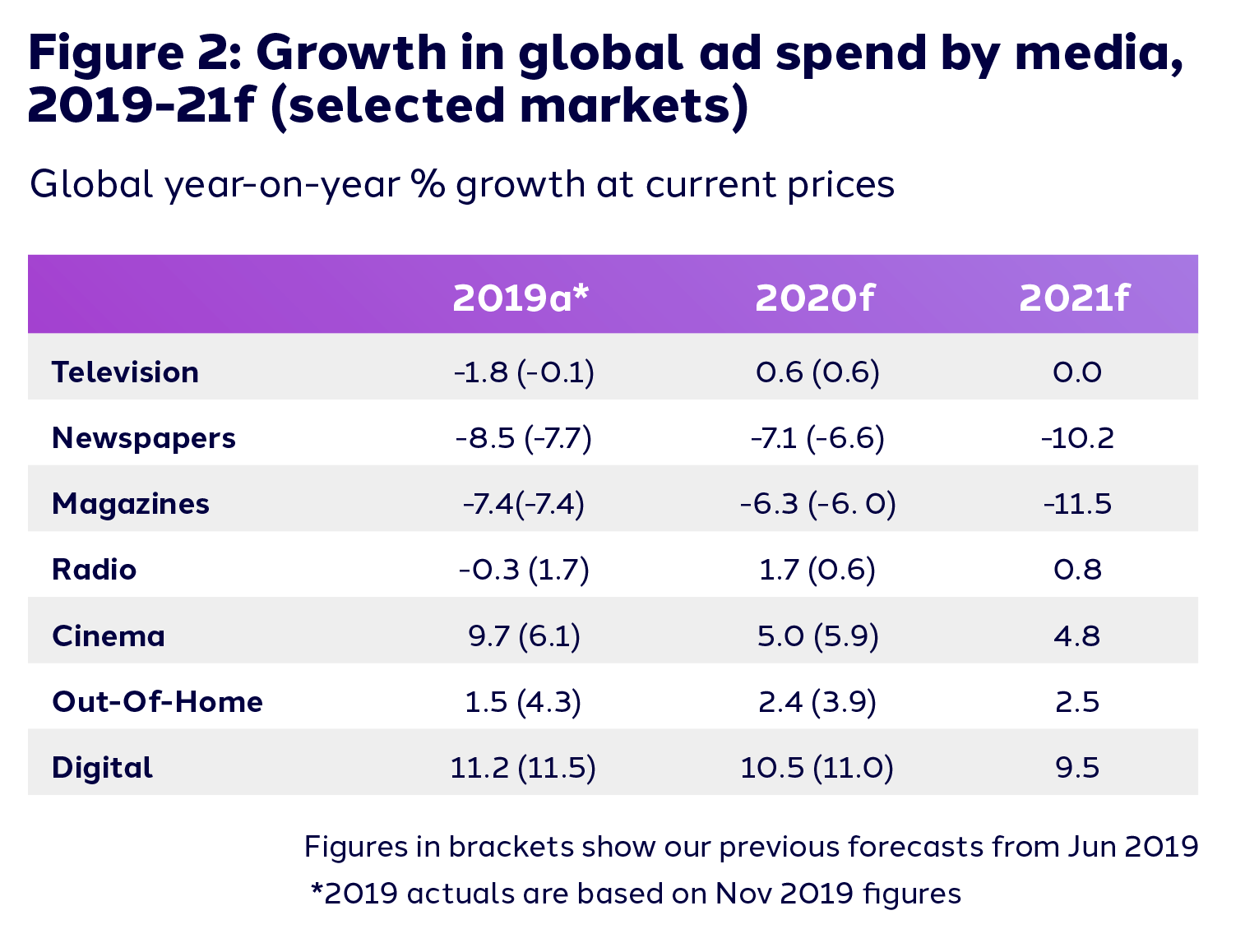

- Digital ad spend remains a key driver of growth and is breathing new life into traditional formats, such as radio and TV.

Dentsu Aegis Network’s revised advertising spend forecast for China predicts growth of 3.9% building on a 3% growth rate in 2019. Spending in 2019 was impacted by the overall slowdown of the China macro economy and the impact of Sino-US trade tensions.

The impact of the Coronavirus outbreak in Q1 2020 will pull down annual growth and limits on movement during the period have influenced people’s entertainment activities and purchasing behaviour.

Some of these changes will continue even after the epidemic. Ecommerce is forecast to capture a 42.4% share of all digital spend in 2020 and will be boosted as consumers moved online to make essential purchases. Short video, mobile gaming, news and online video are the top four app categories during this period (QuestMobile), and advertisers are adjusting spends accordingly. Corporations and consumers have embraced cloud solutions to remain connected, accelerating digital transformation.

Looking forward into 2020, the Tokyo Olympics and Paralympics will be a significant driver of increased ad spend in China and around the world as advertisers look to capitalise on huge audiences.

The underlying trends from 2019, paint a nuanced picture for advertising investment. Traditional TV and Radio have contracted more sharply than in previous estimations, (-8.1% and -12.7% respectively)

Digital and OOH were the only channels in growth in 2019, whilst all other media channels weakened by varying degrees. OOH faces a difficult year with -6% growth coming after a disappointing 2019. Growth in 2019 contracted to 0.6% and 2020 performance will be impacted by the heavy loss of activity in Q1, as advertising changed formats in response to the controls imposed on outdoor activity due to the coronavirus epidemic.

Online video is still an important format for digital advertising with a 10.3% share of total digital spend. Growth is limited by inventory issues and a shrinking commercial audience size as viewers opt for VIP paid memberships, and opt out from watching long pre-roll ad formats. However, online video enjoyed growth during the COVID-19 quarantine period driving inventory and increasing paid subscriptions.

Mobile continues to be a key driver for China Digital spend and is expected to increase by 17.6% in 2020 and accounting for 77.5% of total digital advertising spend. This will continue to grow with diverse formats and the expansion of 5G. As China's programmatic advertising market matures, more media platforms have accepted programmatic buying. With more ad formats served programmatically and increased premium positions available, advertisers have embraced this expanded choice. This is reflected in the growth rate of Programmatic which is estimated to be 45.7% in 2020.

Michelle Lau, CEO, Dentsu Aegis Network China, said:

“Forecasting the impact of the coronavirus outbreak into the rest of 2020 remains fluid but we are confident in the continued resilience of Chinese consumers and business. Marketers in 2020 need to manage contrasting dynamics; long and short term, global and local, digital and traditional. Ultimately, they need to remain focused on long-term sustainable growth by winning, keeping and growing their best customers.”

A Global View:

Globally, Digital continues to power ad spend growth in 2020 and is forecast to grow 10.5%, reaching US$276 billion and 45.7% of global spend. Growth remains strong into 2021 putting digital’s share of ad spend at nearly 50% at the start of the new decade. Within digital, mobile and video are fuelling growth. Both are forecast double-digit growth in 2020 at 16.5% and 14.6% respectively.

Digital is also breathing new life into traditional formats, with television and radio showing signs of recovery with a return to growth in 2020. TV is predicted to maintain around one-third (31.5%) of global ad spend share, growing at 0.6% this year. Radio too is forecast to grow at 1.7%. Voice assistants, addressable TV and programmatic ads are driving spending in these more traditional mediums.

‑ ENDS ‑

For further information contact:

Sarah Weyman

Chief Growth Officer

sarah.weyman@dentsuaegis.com