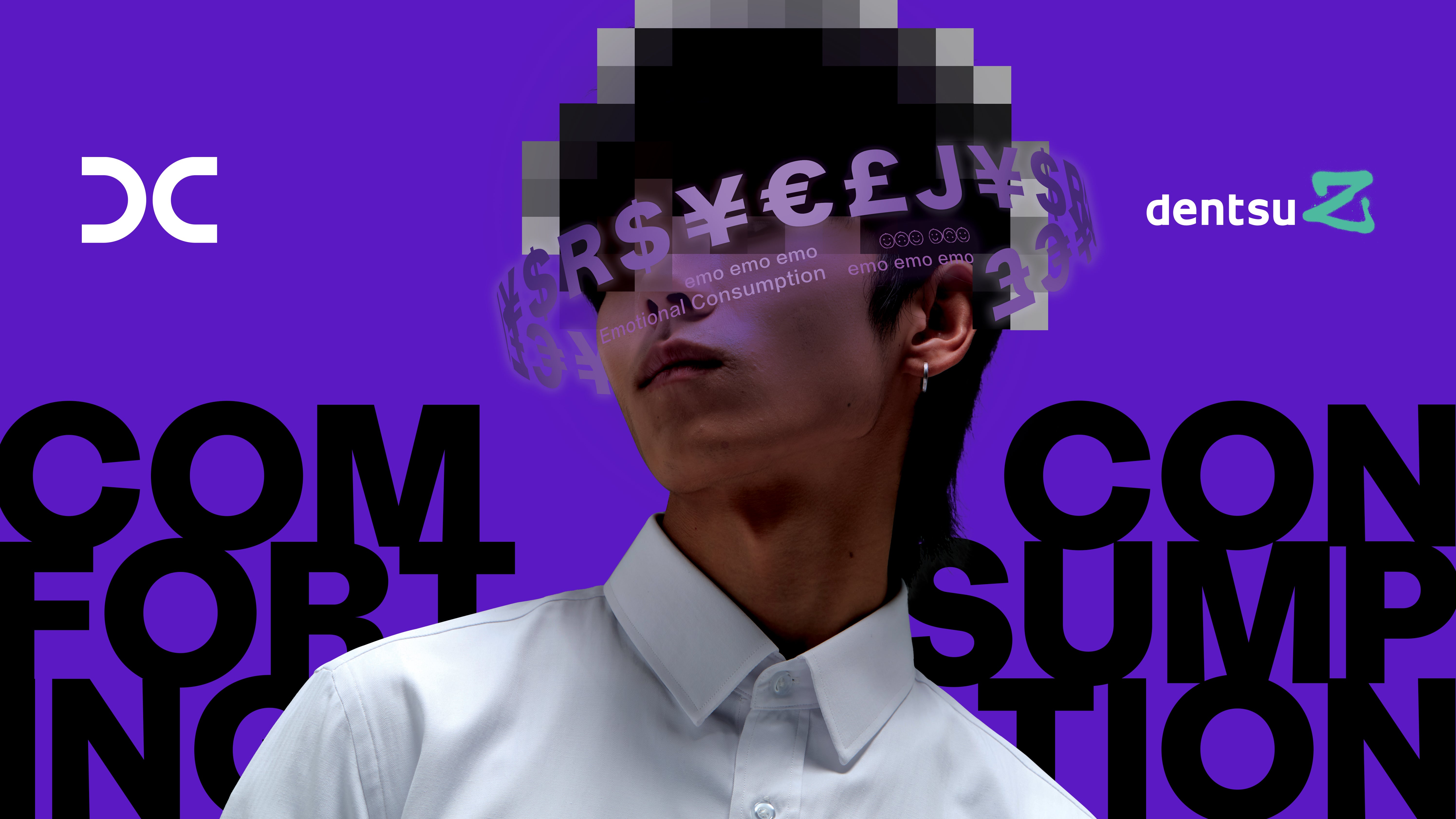

Inside Gen Z’s Comforting Consumption | dentsu Z

A shift within Gen Z for how they consume brands based on their emotional values.

dentsu Z team, as DENTSU CREATIVE's pioneering force of Gen Z creatives, proactively make strategic plans and propose solutions for clients, explore innovative ideas by putting cutting-edge technology into practice and create profound cultural experiences. As both consumers of generation Z and young creatives, dentsu Z deliver direct insights, create connections between the brand and the consumers of the next generation.

How to own the power of still water and the feelings of relaxation.

How to quiet quit.

How to get rid of mental internal friction.

...

You could learn all the answers from bloggers and influencers on Little Red Book, and this is how they boost social buzz—by selling these anti-anxiety therapies.

For Gen Z, they are splashing out on satisfying emotional needs: meditation in spring, frisbee and camping in summer, and tea-brewing over charcoal fire in autumn and winter. According to DataBridge, the global meditation market is expected to reach USD 20.5 billion by 2029. On the other hand, the “tea-brewing over charcoal fire” topic generated 360 million views on Douyin.

While the Internet ushers in Web 3.0, Gen Z’s shopping behaviors are also evolving into a new era of 3.0 with the social environment and people’s shopping patterns changing—from the initial pursuit for better quality to spiritual satisfaction, and now the comforting consumption that Gen Z is increasingly willing to pay for.

PET ECONOMY, PAY FOR COMPANIONSHIP.

People often joke that they live no better than a dog. It might be true in real life.

As most Gen Z is the only child in their family, most of the time, they live alone while working in big cities. Then a pet becomes a good companion to ease loneliness. And they are willing to spend lots of money on their pets. The 2022 Reports on the China Pet Economy manifests that the population of pet dogs and cats in China has reached 110 million with a market size towards 250 billion yuan, and the post-90s represent the largest group of pet owners.

Gen Z treat their pets as their children, while they make fun of themselves as “cat and dog servants.” They might ignore WeChat messages from friends, but they cannot resist joining pet owners’ chat groups for pet shopping and socializing. Though being best-deal hunters, Gen Z do everything to pamper their pets—buy pets clothes or medical insurance, get them photographed, or order door-to-door pet massage.

Right now, the pet economy is diversifying into categories from pet food to clothes, products, beauty, healthcare, and more, with pet healthcare making up the second largest market share following pet food. At the 2022 Double 11 shopping festival, sales of pet food and nutritional supplements on vip.com saw a year-on-year growth of 94% and 115% respectively, and both pet dewormers and medical products observed over 80% year-on-year growth. While pet supplies are embracing smart tech, pet store chains are also becoming mainstream.

METAPHYSICS ECONOMY, PAY FOR CONSOLATION.

Quaint as it may sound, despite atheism being mainstream in the market, Gen Z is fascinated by fortune-telling. They check weekly horoscopes on their Monday subway commute as a sense of ritual, turn to tarot readings when feeling confused, and use the Chinese zodiac (bazi) to test compatibility with their friends and colleagues.

A survey from the China Association for Science and Technology shows that at least one out of every four Chinese believe in metaphysics. Astrology blogger Tao Baibai has been rising as a “divination master,” setting a record follower growth of 1.38 million on his first day on Douyin. His fan base grew by tens of millions in one single month.

An App called muyu (wooden fish) is the latest craze in the Chinese Gen Z community. A tap on the screen to play the soothing rhythmic sound that simulates a real wooden fish brings people peace of mind and inner calm. This App, offering a simple way of relaxation, stimulated 593,000 downloads on a peak day, generated 4.8 out of 5 ratings, and even dethroned QQ Music and NetEase Music on the music Apps ranking.

Amid a time of uncertainties, young people want to be distracted from their anxieties through such simple recreational activities. It’s never about whether it can come true or not, but more of an expectation and emotional consolation.

AROMA ECONOMY, PAY FOR VIBES.

People used to wear perfumes to hint their taste and personality. However, Gen Z buy fragrance to be free from anxiety and lift their mood, to console themselves while celebrating daily lives with meaningful rituals. During the pandemic, home scents sales increased by 13%, becoming a new profitable fashion. Topics like “Favorite Scented Candles,” “Gifts to Bring in Good Vibes” and “Most Impressive Perfume” are now the social buzz drivers.

Domestic fragrance brands such as BEAST, To Summer (Guanxia), and Scent Library have joined the race for market share as the category and eCommerce industry thrives. According to Fragrance Industry Analysis and Market Trends in 2022, China’s perfume market size is predicted to hit 20.7 billion yuan in 2023, following a compound annual growth rate of 21.78% in the next five years to outperform the global perfume market.

So how can brands capitalize on the emotional economy?

OUR WORK...

SWEET PAIN

Brand: Fenbid

Creative Agency: DENTSU CREATIVE

Fenbid is another example that spotlighted young Chinese’s pressures and pains during the pandemic. In collaboration with a bubble tea brand, Fenbid created a menu with five ingredients to represent the five pains and aches in our lives, where consumers could customize a cup of sweet drink that reflects their painful experience. The event satisfied Gen Z’s addiction to bubble tea as well as their needs for emotional support, attracting a number of bloggers and consumers to visit the pop-up store while generating over 160 million topic views on Weibo. Fenbid’s social buzz reached an annual peak with 158% year-on-year growth.

Brands that can tap the comforting consumption, transforming emotional capital into product and brand value gain more fans and high returns.