This article originally appeared in The Business Times.

CONSUMPTION across Asia continues to undergo a transformation. as regional economies put the pandemic disruption in the rear-view mirror and consumer demands evolve. Digitalisation is a fact of life but consumers have become increasingly savvy and demand a seamless digital menu to assist with most aspects of day-to-day life, while still possessing a yearning for the human touch.

All companies must balance a consumer's inclination towards human-led experience with their appetite for automation-driven products and services but this is particularly pertinent in the financial services sector. Consumers are starting to perceive financial wellness as part and parcel of overall wellness and are looking to financial services providers as more than just service and product vendors-indeed as custodians of their financial wellness.

To thrive in this landscape financial service brands must offer frictionless convenience. Whilst being extraordinarily adept at leveraging artificial intelligence and the digital tools at their disposal, they must consciously ensure a human component is applied in all interactions with the consumer. Research recently commissioned by global advertising firm dentsu found that consumers, particularly in Asia want financial institutions to think beyond financial products. They want their experience to offer support and education, maintain a genuine human touch at key service touch points, along with offering innovative products that prioritise sustainability, diversity, equity and inclusion (DEi) along with holistic well-being.

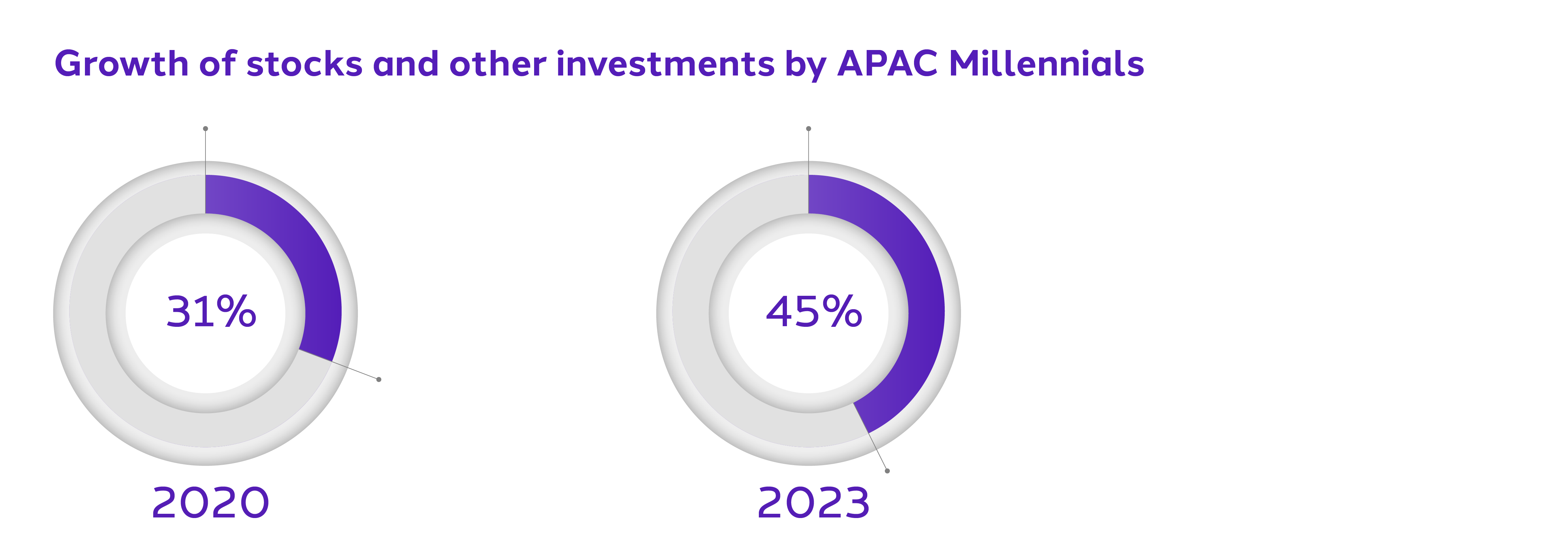

The concept of investing and making your money work for you has come of age in Asia. In dentsu's latest research Finance DNA which was supported by Foresight Factory, data indicates growing engagement with investment accounts by younger age groups: the proportion of Asia Pacific (Apac) millennials who have stocks or other investments grew from 31 per cent in 2020 to 45 per cent by 2022.

This is part of the mainstreaming of the concept of financial wellness as an integral part of overall wellness. As financial wellness becomes solidly intertwined with general well-being, brands must support their customer's holistic well-being including mental health. By creating an open dialogue about the link between financial health and mental well-being, brands can connect with their customers on a deeper level.

Relatable financial advice for Gen Z

Financial advice must be more accessible and engaging than ever before. Partnering with financial influencers and leveraging social media platforms can make financial advice relatable to Gen Z who are comfortable using social platforms for educational purposes. Beyond demonstrating progress towards their environmental, social and governance (ESG) and DEi targets, banks and other financial services providers have a great opportunity to build ethical considerations directly into their products.

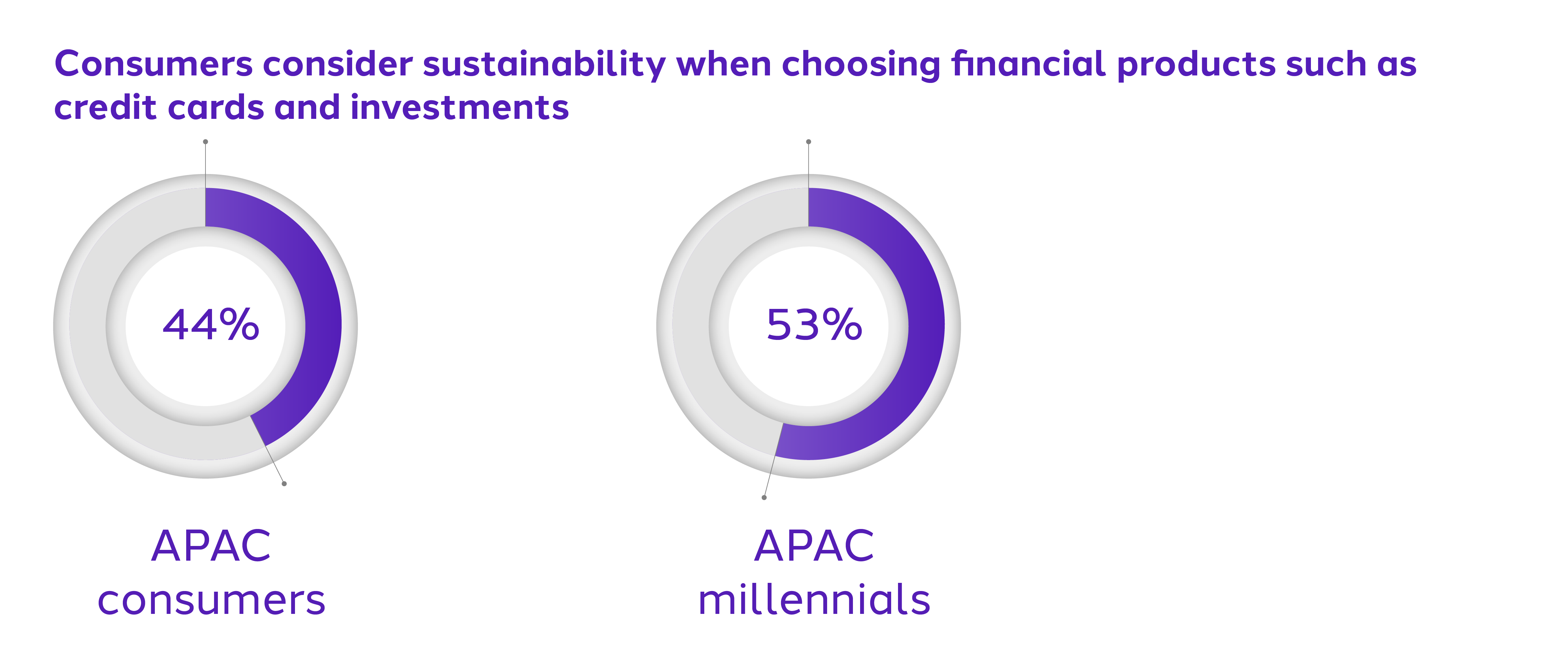

Offering products which allow consumers themselves to participate in social and environmental good is a yet-to-be-saturated strategy. Some 44 per cent of Apac consumers already say they always or sometimes consider sustainability when choosing financial products such as credit cards and investments, rising to 53 per cent among the millennial set.

Happily, the sector's ability to access spending data is matched by consumers showing a growing acceptance in finance brands collecting and monitoring spending patterns to offer an improved service. Close to two-thirds of Gen Z consumers in Apac would be interested in a financial service which links to their bank account or credit card and analyses personal spending to help them budget better and meet their financial goals.

Within Asia's uneven demographic landscape, we have witnessed the inexorable migration to the digital economy especially among the middle-income urban class that has taken place while significant swathes of the population remain unbanked or underbanked. Still, consumers expectations for empathetic, real-time human, or al least human-like services are only set to intensify. In 2022, 57 per cent of Apac consumers used a chat messenger service to speak to a customer service assistant at least monthly.

The core challenge for brands will be to offer automated solutions that can respond rapidly to customer needs while maintaining a sense of human interaction. A major focus for financial brands over the coming decade will be to increasingly embed human-like propositions into fully automated customer service and brand engagement channels. To achieve this, Al will be vital to power digital assistants that react and respond to customer needs in ways that seem empathetic and emotionally responsive to the context and issues faced by the customer.

We're already seeing this trend play out. South-east Asian banks such as DBS, Standard Chartered and CIMB use big data, Al and data analytics to meet customer's digital expectations and to enhance customer experiences. They are deepening their expertise with Al-enabled machine learning, conversational platforms, augmented reality and virtual reality among others. Their regional and global fintech counterparts such as Trust Bank and Revolut are effectively employing these technologies to target and service new customer niches who have previously had limited access to banking services.

In the second half of this decade, we'll see an increased interest for brand platforms that allow for community building and P2P customer interactions. As advances in biometric and emotional tracking technology improve the ability of automated brand services to mimic human interactions, such services will become the growing norm across the sector.

To learn more about the latest trends and suitable campaigns, download Finance DNA APAC.

Or complete the form below to speak to one of our experts about creating a roadmap to resilience.

Leave us your details and a member of our team will get back to you as soon as possible.

Thank you!

Your details were submitted successfully.

There was a problem!

It seems there was an error submitting your details. Please try again later.