Olympics, Euros and US elections Spark Ad Spend Growth in 2020

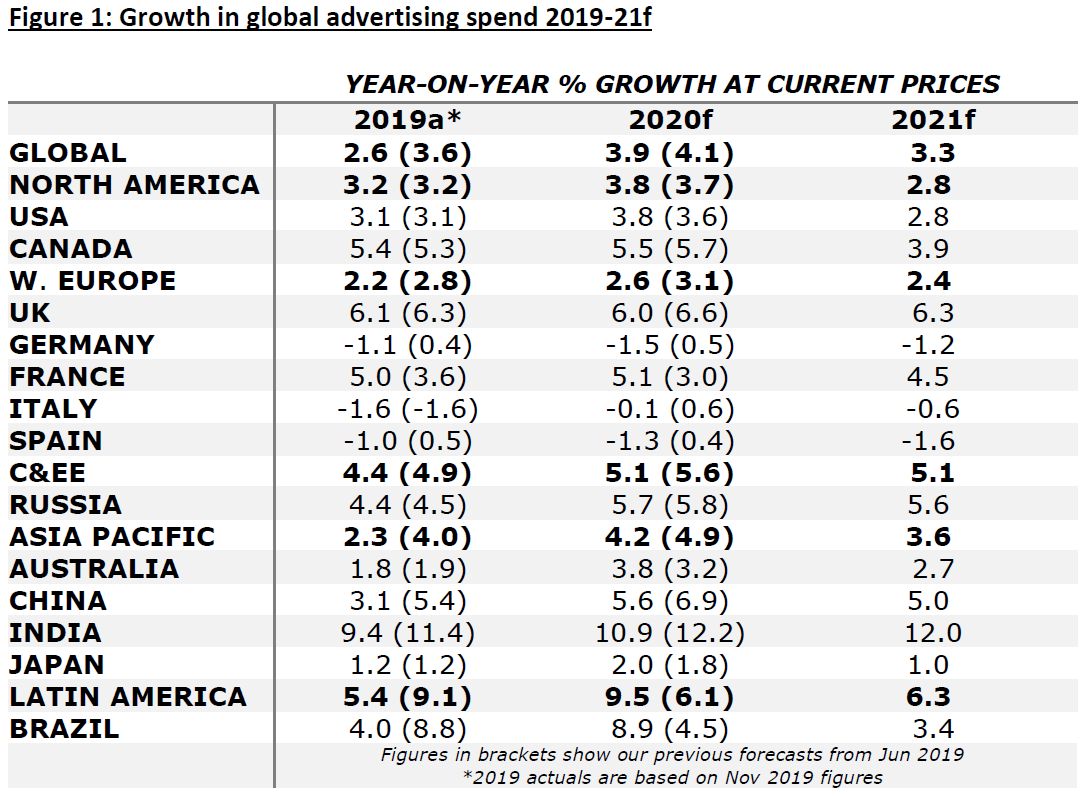

- Global events boost ad spend growth to 3.9% in 2020, up from 2.6% in 2019.

- APAC continues to be the fastest growing economic region in the world, but our two largest economies, China and India are on very different growth paths.

- Digital ad spend remains a key driver of growth and is breathing new life into traditional formats, such as radio and TV.

- 23rd January 2020. Dentsu Aegis Network’s latest advertising spend forecasts, based on data from 59 markets, predicts global growth of 3.9% in 2020, amounting to US$615.4 billion, building on growth of 2.6% in 2019.

With the Tokyo Olympics and Paralympics, UEFA European Football Championships and the US Presidential elections all taking place in 2020, events will be a significant driver of increased ad spend around the world as advertisers look to capitalise on huge global audiences.

It is a mixed picture in APAC, which continues to be the fastest growing economic region in the world. Our two largest markets are on very different growth paths, and we have revised our 2020 growth forecast down by 0.7% to 4.2%.

India continues to go from strength to strength, anticipating double-digit growth of +10.9% in 2020 and +12% in 2021 owing to a surge in smart phone adoption creating a boom in Mobile innovation. On the contrary, growth in China slows to 5.6%, revised down from 6.9%, and we forecast a continued slowdown into 2021. This is alongside the economy’s moderated growth in recent years, as well as slowing retail sales and industrial output.

It is also a mixed picture in South East and North Asia. In South East Asia, the Philippines (+4.7%) and Malaysia (+0.7%) experienced more growth than predicted in our June report. Malaysia has performed strongly, with a positive economic outlook creating a spending appetite for advertisers. Contrastingly we have scaled back our growth projections for Indonesia, Vietnam, Singapore and Thailand. It is a similar situation in North Asia where caution continues. South Korea has halved its growth projections since June 2019 to 2.3%, while Hong Kong’s growth has stalled after a difficult year in 2019 (-10.9% vs 2018).

APAC continues to be the most Digitally advanced region in the world. Digital’s share of total ad spend exceeds 51%, led by China (67.7%), Hong Kong (60.1%), Australia (55.8%) and New Zealand (54.7%). APAC remains OOH biggest market, and we predict it will continue to grow in 2020 by 2%, with Digital OOH the main source of this growth. The lines between Digital and Traditional media will continue to blur, breathing life into Traditional formats with TV and Radio showing signs of recovery globally in 2020. Voice assistants, addressable TV and programmatic ads are driving spending in these more traditional mediums.

Ashish Bhasin, CEO, Dentsu Aegis Network APAC said: “APAC continues to lead the digitalisation of the Global economy, and we are seeing a surge of users in markets introducing new Digital innovations which leapfrog development in the West. China is the largest smartphone market in the world, with India overtaking the US in 2018 to be the second – the merging of Mobile with Traditional formats will continue to be an opportunity for growth in this region as markets mature. Global marketeers should look to APAC for developments in Tech and Mobile to discover opportunities to innovate their consumer offering and create long-term retention and value.”