Growing but slowing: the outlook for advertising in 2023 from latest dentsu ad spend report

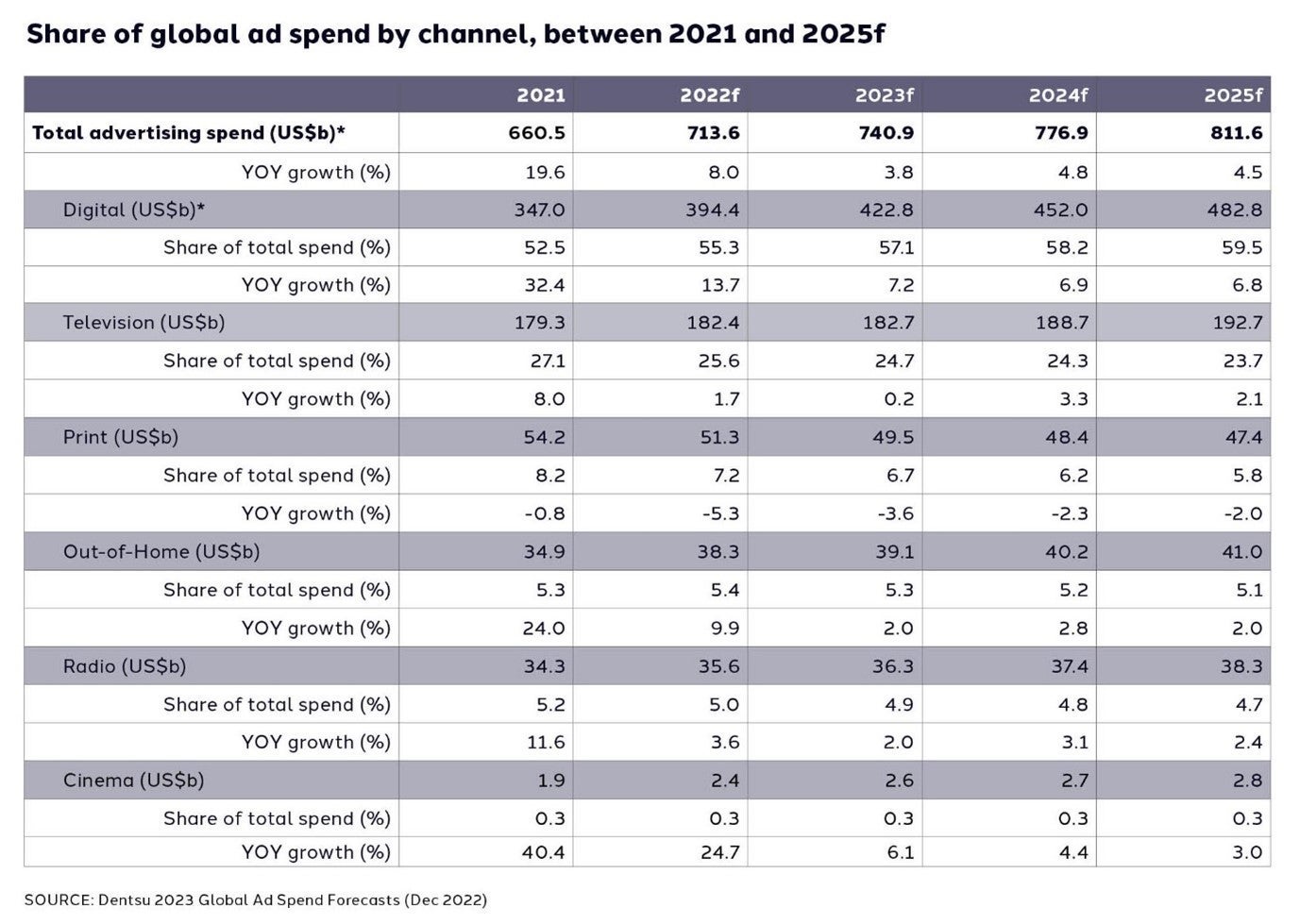

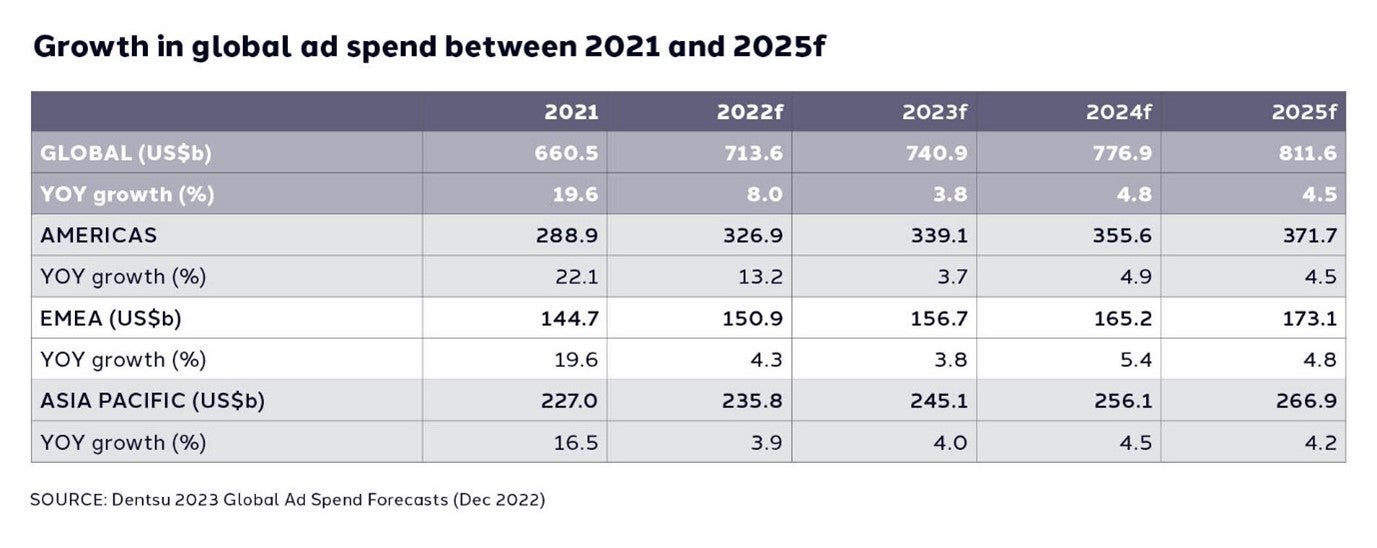

Advertising investment is forecast to grow by 3.8% globally in 2023, according to the latest dentsu Global Ad Spend Forecasts report. The twice-yearly report which combines data from close to 60 markets worldwide, anticipates US$740.9 billion will be spent globally next year.

The dentsu Global Ad Spend Forecasts for 2023 points to a continued growth, although at less than half the pace seen in 2022 (+8.0%), a trajectory which will see industry advertising investment of approx. US$713.6 billion by the end of this year.

Immediate factors including rising inflation, increased interest rates, market recessions, continued political uncertainty and the resulting impact on business and consumer spending have all led to these slower expectations for the year ahead. Exploring this further in the top spending markets*, the dentsu Global Ad Spend Forecasts report has identified a significant proportion of the growth in 2023 will be driven by media price inflation; ad spend at constant prices is predicted at –0.6% compared to 3.4% growth at current prices.

However, at a global scale stronger growth isn’t far off, with 2024 advertising spend now expected to increase by 4.8%, to reach US$776.9 billion, followed by a further 4.5% growth in 2025 to reach US$811.6 billion.

Peter Huijboom, Global CEO, Media and Global Clients, dentsu international said:

“2022 has proven to be another strong year of growth for the ad industry, despite the political and economic uncertainty that surfaced. It is clear from our report and forecast the effect of this is being felt into 2023 too, and we need to be realistic on how this will impact the industry, the inventory, and the returns we should expect from available budgets.

“With the increased business focus on immediate gains to help ride out this temporary economic slowdown, we should expect to see more performance campaigns prioritised, which in turn will impact the channel mix. This is likely to be one of the main reasons we are seeing such strong growth in Digital in the short term, taking it up to 57.1% of all spend in 2023.”

Digital spend is expected to reach US$422.8 billion by the end of 2023, accounting for 57.1% of all advertising spend, this will increase further to 58.2% share in 2024 and 59.5% in 2025. Growth, which is supported in the next year by Video (+7.1%), Paid Social (+13.5%), Search (+7.2%), and Retail Media (+22.0%).

Growth is expected in almost all other channels too: Television ad spend expected to grow by 0.2%, reaching US$182.7 billion, with gains modest gains also present with Out-of-Home (+2.0%), Cinema (+6.1%) and Audio (+2.0%). Ad spend in newspapers and magazines will continue to decline by -3.6%, but there is growth within online news and magazine spending, as publishers start to pivot from paper traditional paper formats.

This dentsu Global Ad Spend Forecasts report not only looks at the data from 58 markets, but also examines some of the key factors impacting the regions, advertising sectors and sustainability.

Once again, all Russian investments are omitted from the forecast, to better reflect the rest of the international ad spend trends and predictions. The full dentsu Global Ad Spend Forecasts can be downloaded for free here: dentsu.com/reports/ad_spend_january_2023

PRESS CONTACTS

John Mayne / +44 (0)7929 856 435

john.mayne@dentsu.com / media.pressoffice@dentsu.com

NOTES TO EDITORS

*Top 12 markets analysed to identify the rationale behind ad spend growth in 2023 are: USA, China, Japan, UK, Germany, France, Australia, Brazil, India, Canada, Italy, Spain.

About the dentsu Global Ad Spend Forecast:

Advertising expenditure forecasts are compiled from data collated from Dentsu International brands until the second half of November 2022 and based on local market expertise. Dentsu International uses a bottom-up approach, with forecasts provided for 58 markets covering the Americas, Asia Pacific and EMEA by medium: Digital, Television, Print, Out-of-Home, Radio & Cinema. The advertising spend figures are provided net of negotiated discounts and with agency commission deducted, in current prices and in local currency. Global and regional figures are centrally converted into USD at the November 2022 average exchange rate. The forecasts are produced biannually with actual figures for the previous year and latest forecasts for the current and following years all restated at constant exchange rates.

While ad spend for the Russian market was present in the January 2022 edition of the dentsu Ad Spend Forecasts, this has been removed from subsequent editions and all values for previous years, referenced in this edition, have similarly been adjusted for accurate comparison. Note historical ad spend figures have all been restated to constant exchange rates from November 2022.

About dentsu international:

Part of Dentsu Group, Dentsu International is a network designed for what’s next, helping clients predict and plan for disruptive future opportunities and create new paths to growth in the sustainable economy. Dentsu delivers people-focused solutions and services to drive better business and societal outcomes. This is delivered through five global leadership brands - Carat, Dentsu Creative, dentsu X, iProspect and Merkle, each with deep specialisms.

Dentsu International’s radically collaborative team of diverse creators unifies people, clients and capabilities through horizontal creativity to help clients create culture, change society, and invent the future.

Powered by 100% renewable energy, Dentsu International operates in over 145 markets worldwide with more than 46,000 dedicated specialists, and partners with 95 of the top 100 global advertisers.

www.dentsu.com