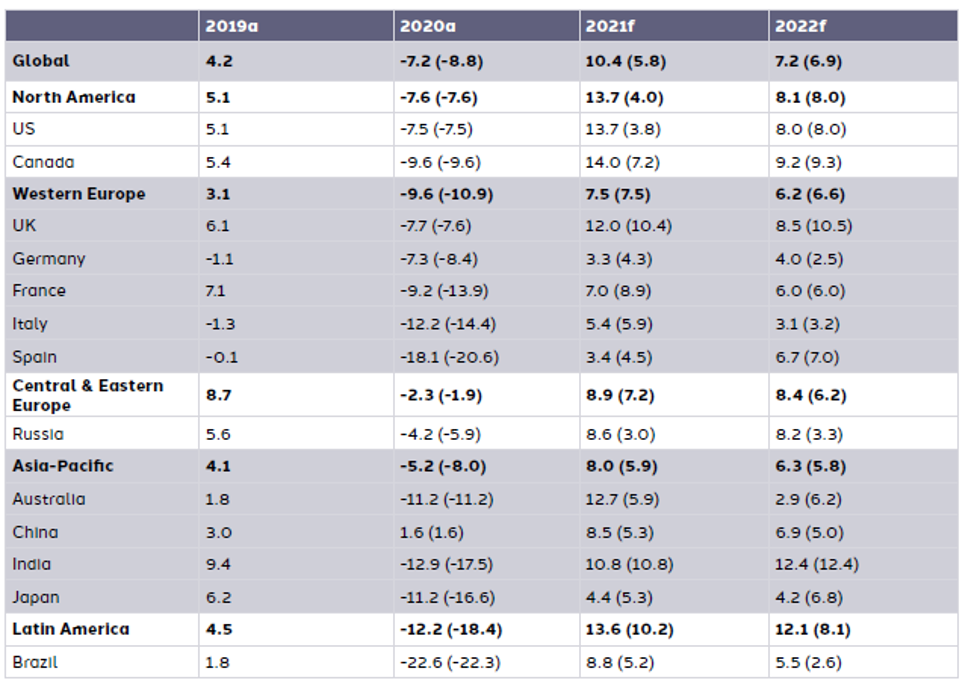

Dentsu Report Highlights Green Shoots of Ad Spend Recovery Led by Digital Resilience, Promising Growth Into 2022

- Global advertising spend is expected to grow by 10.4.% or US$60bn to US$634bn

- Spend will rise past pre-pandemic levels, a year sooner than previously predicted

- All regions forecast to return to growth in 2021 with Canada, the US and Australia expected to be fastest growing markets in 2021

- Digital continues to drive recovery, returning to double digit growth. It will represent 50.0% share of global spend this year

London: Advertising investment is forecast to grow by 10.4% globally in 2021, according to the latest dentsu Ad Spend Report.

The twice-yearly report which combines data from 59 markets, anticipates US$634bn will be spent globally with all regions enjoying positive growth.

Canada, US, Australia, UK and India are forecasting particularly high growth rates in 2021, with 2021 growth expected to exceed pre-pandemic levels in 5 of 13 top spending ad markets – Canada, China, Russia, UK and US.

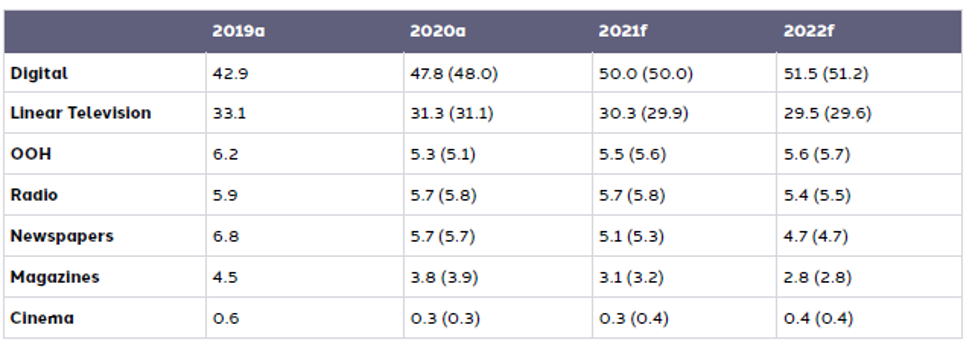

The pandemic-induced decline in global advertising spend during 2020 has proved less severe than anticipated, with some trends which emerged during the past year remaining. The 4.0% rise in digital spend last year is forecast to grow by 15.6% in 2021 to reach US$311.0 billion, representing a 50.0% share of global ad spend. Forecasts for Social (23.0%) and Video (17.0%) will also rise, with Search also growing (16.3%) reaching US$110.1 billion in 2021.

Most channels will return to growth in 2021 with the exception of Print, seeing a slight decline (–4.4%) on a global level as it continues to evolve towards new modes of digital delivery. With restrictions lifting on social activity, Cinema and OOH will see a bounce back post impact of the pandemic, rising 35.1% and 14.6% respectively. Radio will also see growth (10.4%) driven by digital Audio and TV (7.1%).

While live events such as the UEFA European Football Championships and Olympic and Paralympic Games Tokyo Olympics and Paralympics continue to be a significant driver of growth in Linear TV ad spend (7.1% increase in 2021 to reach US$188.4 billion), the dentsu report data suggests a shift towards CTV (Connected TV) and OTT (Over-the-Top) and audiences moving more towards digital media consumption mean global Linear TV spend will remain below pre-pandemic levels until beyond 2022.

Looking at the industries who will see growth in ad spend this year, it will come as little surprise that Government spending remains a key growth area, supporting the Covid vaccine rollout and other related initiatives. The travel and transport sectors, although still affected by the uncertainty of the past year, will see an increase in demand (8.7%). Media & Entertainment is forecast to see growth (8.9%) and Automotive advertising to rise (9.5%).

The decline in global advertising spend prompted by the pandemic in 2020, has proved to be less severe than originally anticipated. While 2020 remains the weakest performing year since the global financial crisis, the decline in growth during 2020 has proved less severe than anticipated and has been raised since dentsu’s January 2021 forecast (from -8.8% to -7.2%.) In 2021, the market is seeing a recovery in growth (10.4%), an improvement (4.6% pts) on January’s predication. Looking to 2022, recovery is set to continue when spending is likely to reach US$680 billion and grow at a rate of 7.2%.

Peter Huijboom, Global CEO Media, dentsu international said:

“The shift in consumer behaviour experienced during the pandemic has changed the advertising landscape. Trends we saw developing ahead of 2020 have now become mainstay, such as the shift to digital, e-commerce and the need for greater personalisation in media targeting.

Brands need to be increasingly agile and flexible, continuously making informed decisions regarding media channels based on data and insights. Investment in analytics is key and will help to build a view of how behaviours are evolving in future years. Dentsu’s Ad Spend Report continues to provide extremely valuable insights for our clients and the wider industry.”

Growth in global ad spend between 2019 and 2022

Year-on-year % growth at current prices (January 2021 figures in brackets)

Share of global ad spend by channel between 2019 and 2022

January 2021 figures in brackets

The dentsu Ad Spend Report can be viewed here.

‑ ENDS ‑

For further information contact:

Fiona Magill, Interim Head of PR, dentsu international | Fiona.Magill@dentsu.com

Notes to Editors:

Advertising expenditure forecasts are compiled from data collated from dentsu’s brands and based on our local market expertise until the second half of June 2021. We use a bottom-up approach, with forecasts provided for 59 markets covering the Americas, EMEA, Asia Pacific and Rest of World by medium: Linear Television, Newspapers, Magazines, Radio, Cinema, Out-of-Home and Digital Media. The advertising spend figures are provided net of negotiated discounts and with agency commission deducted, in current prices and in local currency. For global and regional figures, we convert the figures centrally into USD at the May 2021 average exchange rate. The forecasts are produced bi-annually with actual figures for the previous year and latest forecasts for the current and following year all restated at constant exchange rates.

About dentsu international

Part of dentsu, dentsu international is made up of six leadership brands - Carat, dentsu X, iProspect, Isobar, dentsumcgarrybowen, Merkle, and supported by its specialist brands. Dentsu International helps clients to win, keep and grow their best customers and achieve meaningful progress for their businesses. With best-in-class services and solutions in media, CXM and creative, dentsu international operates in over 145 markets worldwide with more than 45,000 dedicated specialists.