2020 is shaping up to be a year of unprecedented disruption. With the coronavirus currently dominating our lives, 2020 also looks to be a year of highly charged debate within our industry, particularly the subject of viewability duration for video ads, with significant commercial implications for media owners and clients.

Clients will hear about the need to meet duration thresholds and completion rates, they will hear that very short durations can work, and long durations will “cost”. Industry debates will be polarised, possibly ill-informed, and definitely confusing!

The extensive work DAN (Dentsu Aegis Network) has been doing on audience attention measurement sheds vital light on this area.

In this POV I outline the commercial implications and provide a (hopefully) well-informed answer on how duration should be reported, and how should it impact the way we plan and buy impressions across different media offerings.

Make no mistake, This is a big issue

The MRCs plan to launch a new standard in January 2021, Ebiquity’s “Mind the Gap” report and Facebook’s quick response to it, are all testament to the commercial importance of the issue.

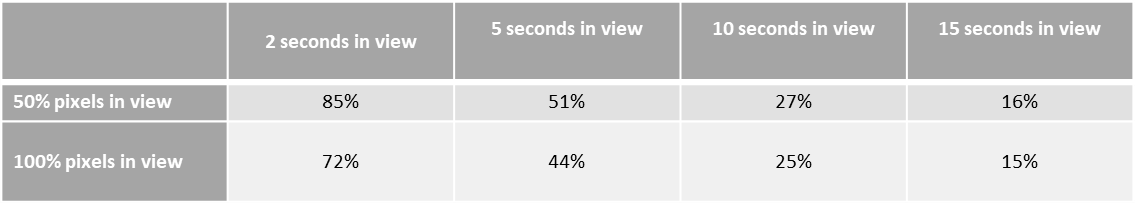

The MRC, who set “viewability” standards for the industry, are already in consultation about toughening the minimum pixels standard from 50% of pixels in view to 100% of pixels in view. In January 2021, the industry will see them produce a formal guideline about viewable duration, currently set at a minimum of 2 seconds for an impression to be counted.

Even this 2 second minimum standard is contested by certain digital platforms, who cite research demonstrating that partial views and very short exposures “work”, and thus by implication, advertisers adhering to the MRC standard are leaving value on the table.

In fact, the drop off in available inventory to meet the 2 second minimum has not been very profound and therefore has limited the negative impact on platforms commercially. UK data from DAN’s Attention Economy research shows that 86% of tested video ad views met the 50% pixels and 2 second standard, and 72% still passed the standard at 100% pixels in view (based on 15 second ads tested).

The current MRC standard therefore leaves plenty of inventory “in play” and combined with initiatives like the Coalition For Better Ads (CBA) has been showing improving standards of inventory across the board. If a client wants to buy only inventory that exceeds the MRC standard, they can go ahead and do so, paying whatever price prevailing demand determines.

Duration however is different. The bets are on the MRC coming up with a requirement to report “ad completion rates” i.e. % of the ad length viewable. It appears this may remain just a requirement to report the information and it is unclear on whether a full-on minimum standard will be set, but even the existence of such a metric will fuel hot debate.

The recent Ebiquity 'Mind the Gap' Report appears to promote the use of completion rates as a value metric and highlights the profound effect that meeting certain completion standards would have on inventories. The report concludes: “When we move from a pure impression-level analysis to applying 50% or 100% completed reach criteria, both YouTube and Facebook deliver less reach”. In fact, this is an enormous understatement. Across a range of test campaigns, the Ebiquity research shows that YouTube and Facebook campaign reach reduces by roughly 60-90% respectively if one applies a standard of 50% completion and reduces by an enormous 80-90% if that completion standard increases to 100%.

The problematic commercial issue of setting completion thresholds is also demonstrated in DAN research. Table 1, based on DAN Attention data extracted for UK, In-Feed ads shows how the number of valid impressions declines dramatically as the number of in view seconds/ duration % required increases.

Table 1: % of in-feed video impressions meeting different viewability standards:

Source: DAN Attention Economy Research, Amplified Intelligence Phase 1, 2019

Base: UK, In-Feed Ads, excluding lengths over 20 seconds.

The implication here is that impressions inventory could be decimated with increased duration / completion thresholds. There would be little, if not nothing to sell or buy. No wonder Facebook published an immediate retort: https://mediatel.co.uk/news/2020/02/28/please-mind-the-gap-and-definitely-avoid-falling-down-the-hole/

Why ad completion rates are not the answer

My view, supported by the DAN Attention Economy research from 2019, is that completion rates would be interesting as a reporting standard to sit alongside the MRC audience standard (the audience standard determines what can be counted as an impression) but it cannot be considered an audience standard in itself.

Completion rates might inform on the nature of audience engagement with ads in different environments (for example they can signal when ad is “wearing out” because people stop engaging with the ad) and such knowledge might be useful in building a media and creative strategy. But completion rates cannot be basis for media buys, they are not an outcome proxy, nor are they a generic media value factor.

At a DAN Attention event (UK Client Council, March 2020) Dr Karen Nelson-Field, an expert academic and researcher voice in the attention economy space, called completion rates a “red herring” and “an irrelevant measure”. She made the point that “if you see an ad you can get some sort of picture from it very quickly, you do not have to see it all”. This view was supported by David Basset from Lumen who later said “we know that a single fixation of the eye can be enough to have a positive outcome”.

Dr Karen Nelson-Field, an expert academic and researcher voice in the attention economy space, called completion rates a “red herring” and “an irrelevant measure”.

What is the answer?

We must stop thinking in binary terms, it is not correct in the first place and it fosters an unhealthy tendency to identify “winners and losers” in the delivery of ad viewability durations.

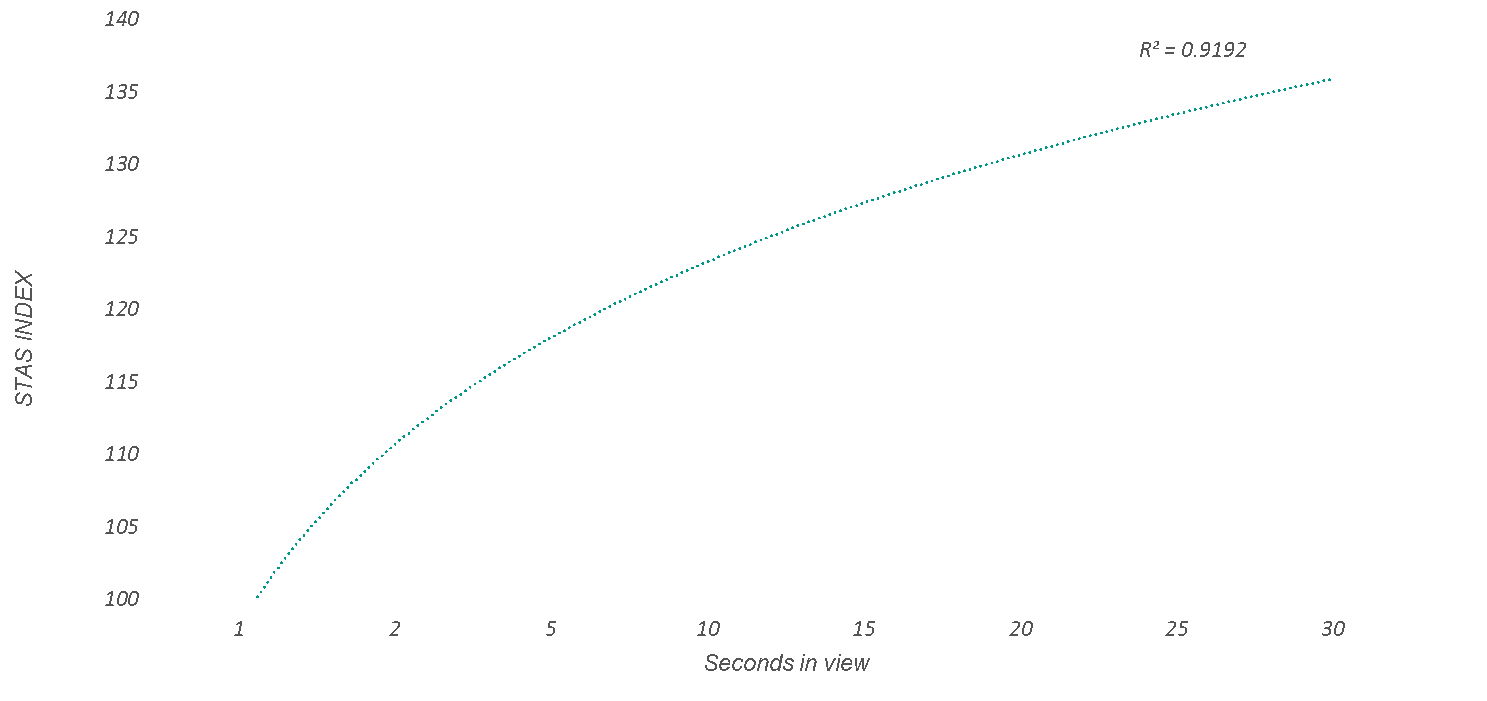

DAN Phase 1 findings clearly demonstrate that the way to value duration is clearly via a response curve, which provides a relative value for all durations delivered. All we need is the requirement to report how many seconds of a client’s ads are delivered, and we can take it from there.

Figure 1 is drawn from DAN Phase 1 data shows that ads can have a sales impact even in a couple of seconds of exposure, more seconds seen is usually better, but there is a point where returns diminish. Such curves demonstrate clearly that a binary argument pitting “1 second is enough” against “it is all my ad or nothing” is not helpful, and nor is the answer setting a threshold, “ok, let’s agree on 2 seconds, or maybe 3 seconds, or how about at least 25%, 50%, 75% completed?”.

Source: DAN Attention Economy Research 2019

Planning with duration in mind

The extensive research that DAN have already conducted and will continue to conduct means that we can guide our clients on how to value platforms in relation to all aspects of viewability duration, but also the duration of audience attention and response which brings us much closer to advertising effectiveness. A recent campaign run by my colleagues at Carat and Amplifi UK for The Co-Op food stores demonstrated this wonderfully by applying attention metrics to their display bidding algorithm to deliver better campaign results. https://www.campaignlive.co.uk/article/co-op-claims-industry-first-online-ads-optimised-attention/1663129

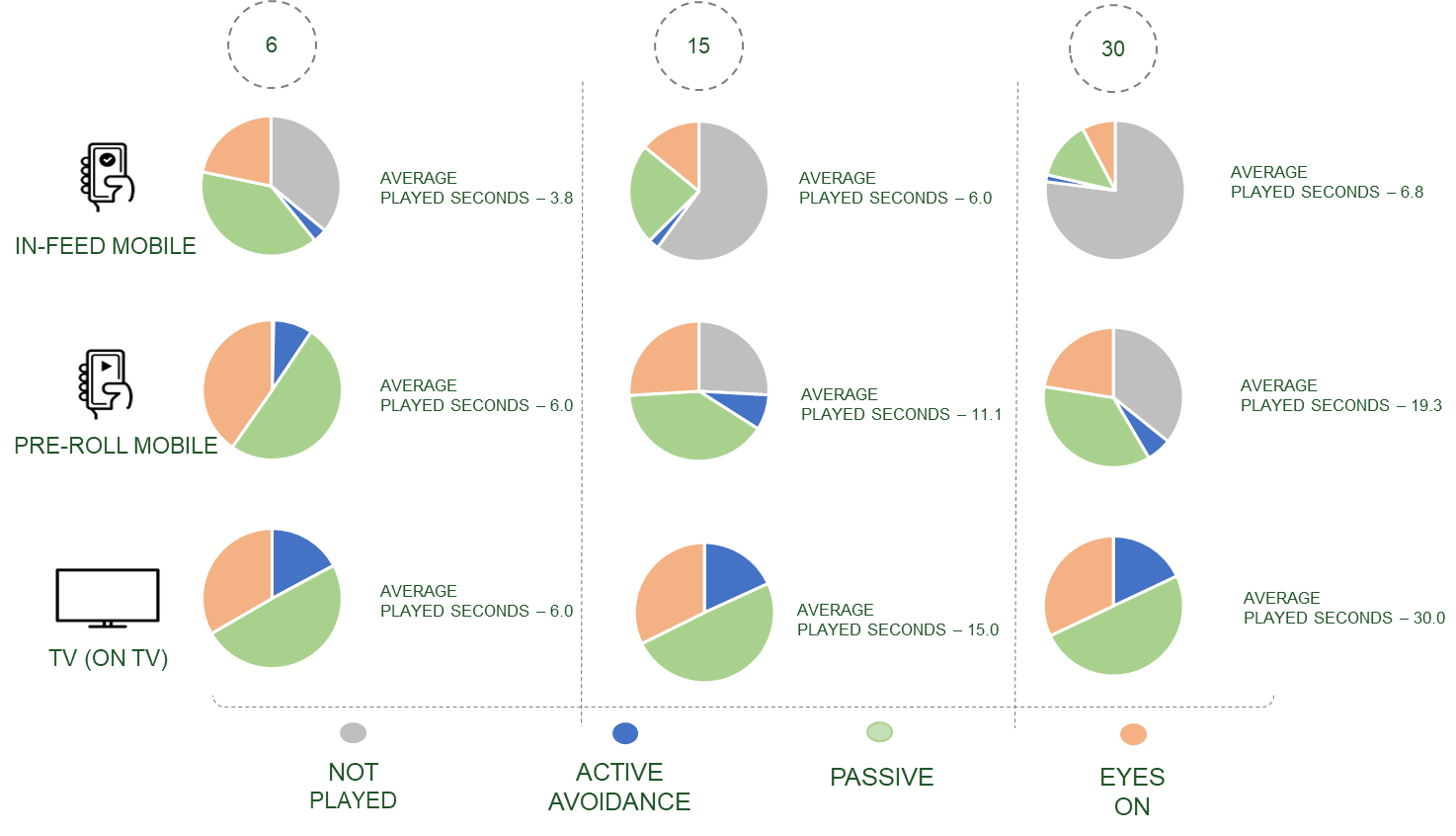

Different platforms and contexts offer different “audience attention budgets”, as David Basset at Lumen explained recently. He explained that at the one end of the spectrum we have cinema, where we can get your ad attended to in all its glory, and at the other end we have digital display and OOH where attention is shorter and more fragmented. This doesn’t mean that cinema is necessary ‘better’ than display, it just means the channels work differently. It all depends on what we are trying to do; build salience, have an emotional impact, launch a new product – these require different levels of attention and different channels will be more cost effective at delivering them.

Source: DAN Attention Economy Research 2019

It is a complex area but often when things are complex the answer should be the simplest. A simple process is as follows (all done within reach of Audience Target):

1. Start with the advertising Task

a. Different tasks need different durations

b. Set the right ad against the right task in the right place

2. Then think Time

a. How much do you need to talk each time you get that “moment to talk”?

b. How much total time do you need to meet and maintain your objective over time?

3. Then Tactics

a. What is the average and maximum potential of each platform?

b. How are you going to get the best out of the opportunity?

4. Testing

a. Test and learn using audience and brand response data

In conclusion...

Optimising creative and media will always need to be in relation to advertiser task since some tasks can be achieved in short duration, but some require more “time to talk”. Informing this is essentially about replicating the many years of research that has led to, now commonly accepted, TV best practices and spot length cost factors.

Thanks to the extensive audience attention and response research we conduct, DAN is further along this path than any other agency, able to value different platforms and formats in a practical and “audience responsive” way for our clients. We do not need further MRC thresholds to do our job in planning and buying for clients, but we do want the MRC to mandate the reporting and recognition of number of ad seconds delivered.

There is a much bigger “advertising ecosystem” picture, however.

The current MRC minimum 2 second duration threshold for an impression to “count” is enough for many brand tasks, and somewhat protects the ecosystem by discouraging a plethora of super-short ads that simply clutter and pollute our environment. But is this enough? Raising duration thresholds, a couple of seconds could be beneficial in this aspect without decimating inventories. An over-zealous approach however would have a negative commercial impact not just on publishers but on advertisers.

The ideal scenario is that all advertisers and all media owners take a more “audience responsive” approach to the inventory and ads they “put out there”. Ultimately only audience attention research can provide the feedback mechanism we need to do this.

DAN is trying to push the industry to adopt “The Attention Economy” not just to improve the impact of advertising today, but to protect the ecosystem longer term.

About Dentsu Aegis Network's 'Attention Economy' Project

Dentsu Aegis Network’s ‘Attention Economy’ is an industry-leading project with a mission to change the way the industry plans and buys media. Launched in 2019 with ground-breaking research, the project is currently in its second phase. The Attention Economy is backed by several global media partners and research partners, TVision, Lumen and Amplified Intelligence.

Clive Record – Global Head of Media Partnerships said ‘The Attention Economy is a vital programme for DAN and its clients and partners. It’s about evolution and not revolution and ensuring that we can measure, plan and buy media as effectively and responsibly as possible across the ecosystem’.

Phase 2 of the project recently kicked-off at an event in London hosted by Dentsu Aegis Network, including a panel session with clients, media and research partners. Results from the second phase of research will be released in the summer of 2020.

Jonathan Waite, Senior Director for Dentsu Aegis Network’s Global Media Partnerships team leads the global project.