Sports, stay-at-home DIY projects, and spending post-pandemic. These are three rising trends taking focus with consumers this week. Below, we provide an in-depth view of these trends and suggestions for how brands can tap into these new behaviors:

America is getting its (e)Sports fix.

From March Madness to the Tokyo Olympics, the COVID-19 outbreak has forced most live sporting events to the bench for the rest of the year. In an effort to appeal to sports fans, sports leagues and media companies have started creating virtual versions of events that were postponed or canceled in real life. Live-streamed virtual races, simulated tournaments and virtual drafts are increasingly coming into play. For example, on March 29, an eNascar race drew record TV audiences: 1.3M viewers, more viewers than any IndyCar race drew on NBCSN in 2019. And this past week, each day of the 2020 NFL Draft established new viewership highs: over 15.6 million viewers watched Round 1 on Thursday (+37 percent vs. 2019).

Additionally, with the sports world on pause, sports fans who have heard of eSports, but may not have had time or a desire to check out the world of competitive gaming now have the opportunity to do so – satisfying their thirst for competition. In fact, 1 in 5 sports fans said they are interested in watching eSports as an alternative to live sports (Morning Consult).

Brands are following these eyeballs and shifting a higher share of their marketing budget into gaming & eSports. After announcing a partnership with five top eSports teams, Jens Thiemer, SVP Customer and Brand BMW said, “Esports shows us how sports entertainment can continue to thrive and play a key role considering today’s challenges.”

Consumers are power nesting in lockdown.

More than offering a cheaper alternative for home-repairs or simply filling an afternoon, home improvement projects are providing people a crucial outlet amid uncertainty. Experts indicate that improving our immediate surroundings can help us feel a bit less helpless. “People feel good when they’re engaged in activities that take a bit of effort and skill,” Howard Nusbaum, a cognitive psychologist at University of Chicago, told the Chicago Tribune. In the face of a pandemic where there’s few ways to help besides staying home, that has a lot of consumers reaching for their gardening tools and paint brushes.

Since stay-at-home orders started, 41% of consumers report spending more time on home improvement or craft projects (Ipsos/Axios). DIY stores and brands are seeing the uptick in demand: purchase intent mentions for Home Depot are up 75% year-over-year and purchase intent mentions for Sherwin Williams are up by over 50% year-over-year (LikeFolio).

Will Americans revenge spend?

As China reopens there are signs of ‘revenge spending,’ leading many U.S. retailers’ question if they’ll see the same trend. The term “revenge spending” was first coined in the 1980’s to describe pent-up consumer demand coming out of the Cultural Revolution. In China, we’re specifically seeing:

- Luxury brands see record days and foot traffic slowly return to malls: The day it reopened to the public, a Hermès flagship store in China reportedly raked in $2.7 million in sales.

- Attention shifting from ‘must-have’ to ‘nice to have’ items: Willingness to spend on leisure goods rose to 39% from Feb. 16th to Mar. 6th, up from 19% over Jan. 15th to Feb. 16th (Publicis Media).

- Government-provided spending vouchers increase consumption at record rate: In Jiaxing City, spending vouchers increased sales by SMEs at over 200x the daily average.

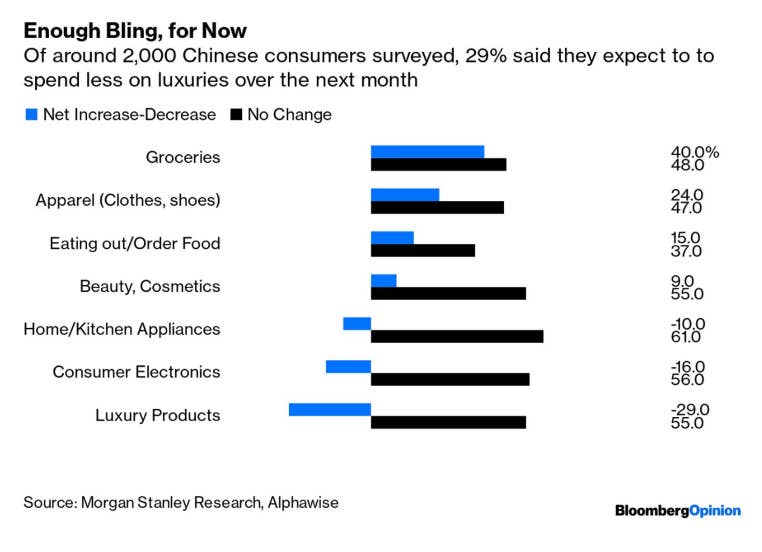

However, experts warn that the impact of these initial signals may be limited. In particular, consumer confidence in China is struggling to fully return to its former glory. Making up more than a third of global luxury sales in recent years, Chinese consumers now continue to keep their purse strings tight:

As US brands look to China to build a playbook on how to return to normal, experts recommend tempering expectations around ‘revenge spending’. While U.S. consumer sentiment is rising, 26.45 million Americans filed for unemployment over the past five weeks.

Our point of view: It’s time to realize that consumption patterns will not resume as if nothing happened and unemployment shocks will not reverse with the speed in which they came. Brands will need to rethink consumer journeys and understand friction points for re-engagement.

What does this mean for modern marketers?

- Consider how you can get involved in the eSports groundswell. With fans desperate for any competitive/sports content, brands can seize the opportunity to experiment with new content forms and reach new audiences. Ask yourself: how can you help create more engaging experiences that connect athletes with fans right now?

- Identify the multiple roles your brand plays for people – it may help them battle powerlessness. As consumers turn to home improvement activities for a variety of reasons – utility/necessity, entertainment, escape, satisfaction, relief and we’re sure many others – brands should consider how their products can not only fulfill functional needs, but emotional needs as well.

- Don’t Count On ‘Revenge Spending’ Post-Crisis. It’s clear that consumers are proceeding cautiously and will for some time. Brands will need to rethink consumer journeys and understand friction points to reengagement. Consider consumer confidence levels when benchmarking success and how helping consumers rebound will contribute to marketing growth.

Download our latest Crisis Navigator Report for consumer sentiment & behaviors >