The media landscape is investing in its reinvention. In this midyear follow-up to the December 2022 edition of the dentsu Global Ad Spend Forecasts, we share the most significant trends that have materialised from the data collected by our investment analysts across 58 markets – and the key implications for media decision makers.

We still expect global advertising spend to grow despite the economic uncertainty. This report, available here, explores key trends seen in the data and shines a light on what they mean for the industry, brands and media owners as we look towards a year with increased pressures and demands on advertising money.

Here, we highlight the findings and what this means for the UK market.

Foreword

Global advertising spend is forecast to increase by US$23.0 billion in 2023 to reach US$727.9 billion. However, media price inflation is the true driver of this increase and hides the more lacklustre reality: 2023 will be a flat year for ad spend. Something interesting is happening in the digital space. This year, digital is not forecast to experience double digit growth.

This has only happened twice in the last 20 years: in 2009 (financial crisis consequences) and in 2020 (COVID-19 pandemic). Digital ad spend is expected to grow by a mere 6.6% three-year compound annual growth rate (CAGR) to 2025. The future will tell if this is a temporary slowdown, or a true inflection point toward a structural slower growth pace for digital.

This does not mean everything is dark and gloomy. First, because we forecast ad spend growth will accelerate again in 2024. But most of all because the media landscape is investing in its reinvention.

Facing climate emergency, the industry is investing in effective carbon management solutions to reduce its carbon impact for more sustainable media. Amidst uncertain economic context, new ad-funded video on demand plans are making content accessible to more viewers and boosting TV investments. AI and new innovations are driving progress everywhere.

UK Market Focus

Global advertising spend is forecast to increase by $23.0 billion in 2023 to reach $727.9 billion. Facing continued economic headwinds and fewer media events, the pace of growth is expected to slow from 7.9% in 2022 to 3.3% in 2023. The markets contributing the most to the US$23.0 billion increase in 2023 are forecast to be US, China, India and the UK.

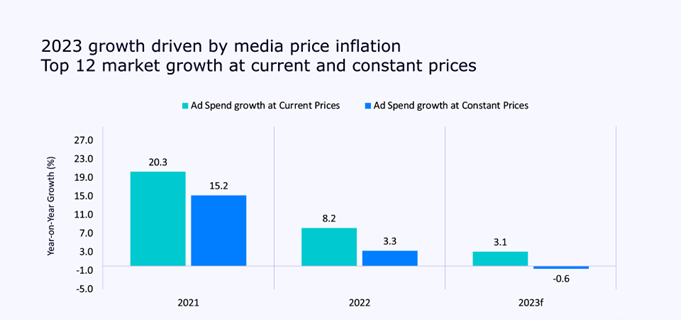

As we anticipated in the December 2022 edition, ad spend growth in 2023 will be driven by media price inflation, with ad spend at constant prices declining by 0.6%. Based on 12 markets including the UK.

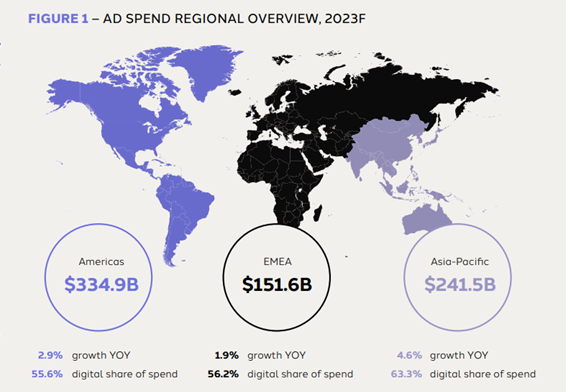

The advertising market in 2023 is expected to retain a positive trajectory in all regions. EMEA is forecast to grow by 1.9% to reach US$151.6b in 2023. This region will be led by UK and France, with 3.1% and 2.6% growth respectively.

The 2023 global ad market is projected to be 24.3% greater than it was in 2019 before the COVID-19 pandemic, with some markets having grown even more significantly in that period. The UK is the market showing the most growth at 45%.

UK Media outlook

Within the EMEA region, the UK ranks as the top and fastest growing market. The world’s fourth largest advertising market is now expected to reach $42.4 billion in 2023, growing by 3.1% (vs. 3.6% in the December 2022 forecasts).

We should be seeing lower levels of media inflation in 2023 compared to the previous two years, as demand remains flat or even declines in some media. TV in particular is seeing much lower levels of inflation as demand declines, particularly across the first half of 2023. Most other media should see prices remain relatively stable, with low single digit increases. Print being the exception to this with a small level of deflation, continuing the long term trend caused by audience declines.

Brands can look at their media mix & ad formats, to mitigate the effects of inflation, but these should be looked at in the context of overall effectiveness.

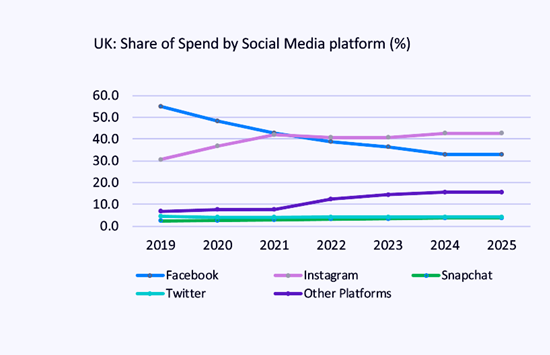

Social spend growth is being driven by new platforms and expanding functionality.

Accounting for more than 70% of UK spend, digital is projected to grow, yet slower than expected (4.5% vs. 6.0% in the previous forecast). TV is expected to contract by 3.0%, with a particularly difficult start to the year driven by macro-economic factors. OOH is forecast to grow by 6.0% and recover to near 2019 levels, with cinema growing by 22.1%, and audio by 2.7%. Meanwhile, the forecast for the print market has improved since the December 2022 report, up from -2.5% to -1.8%.

2023 is expected to be buoyed by key events such as the FIFA Women’s World Cup. Overall, we anticipate a gradually improving picture as we approach the end of the year, ending with strong growth of 4.0% in Q4 2023. Looking ahead to 2024, the UK ad market is forecast to grow by 3.5% with a more positive outlook for TV at 2.0%.

Overall, the market is forecast to show low single digit gains year on year, with a slight revision down from previous growth of +3.6%. Online is still the driving force behind growth at +4.5% year on year, accounting for over 70% of the UK’s total ad spend.

While 2023 looks to be a flat year for ad spend, it’s important to note that the industry is already experimenting with generative AI to increase media effectiveness. From retail media solutions to brand assurance, innovation is all around us and drives progress everywhere, which will make for an interesting 2024.