As new food and advertising regulations reshape the marketing landscape, one truth is becoming increasingly clear: what brands say matters, but where they say it now matters just as much.

In our latest UK Consumer Navigator study, we asked a nationally representative group of 1,020 adults where they most want to hear from food brands on topics ranging from reformulation to sourcing, nutrition, environmental impact and employee treatment. The goal: to understand which channels carry the most trust and where brand storytelling genuinely resonates.

The findings reveal a stark hierarchy – and a major opportunity for brands navigating the LHF rules in 2026.

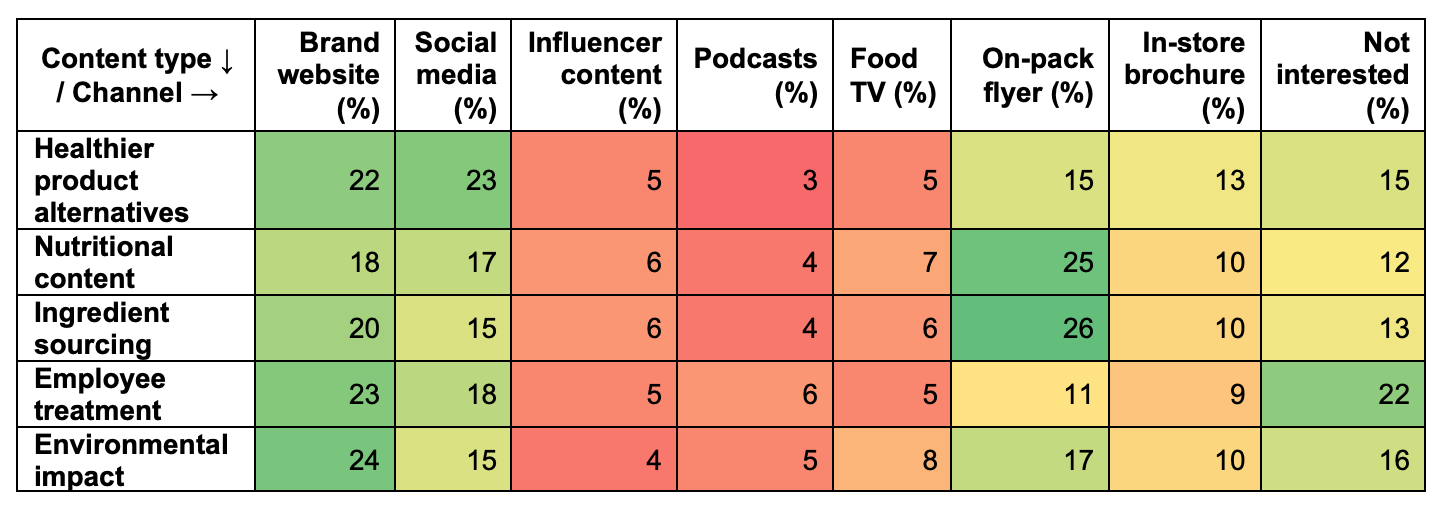

Fig. 1: If food brands were to develop more content about different aspects of their products, where would you most prefer to access and experience this content? Select one for each of the following content types. [Nationally representative survey of 1,020 UK consumers, Oct 2025]

Brand websites are still the home of truth, especially for sustainability and ethics

Across every category related to responsibility, from ingredient sourcing to environmental impact to how employees are treated, brand websites were the most trusted home for content.

- 24% prefer sustainability and environmental impact stories on brand websites

- 23% want employee-treatment information there

- 20%+ consistently choose websites for ingredient sourcing

This tells us that consumers are drawing a clear line:

“If you want me to believe you, tell me on your own turf, and tell me in detail.”

For brands tightening their communications under new HFSS/LHF constraints, websites remain the strongest asset for trust, transparency and long-form storytelling.

When it comes to health, people still go straight to the pack

Despite digital innovation, packaging is still the most influential place for health-related messaging.

- 25% look to packs first for nutritional detail

- 26% want ingredient-sourcing clarity there

- Flyers and in-store brochures also perform strongly for health information

This matters because the LHF rules limit what brands can show in paid media, but packaging remains exempt. It is now, more than ever, one of the most powerful levers marketers still have.

Social media leads for discovery – but not for credibility

Social continues to be a critical channel for reach and inspiration, but the data shows an important nuance:

- It consistently ranks second for “healthier alternatives” content

- Yet it drops significantly for topics requiring trust, detail or transparency

This reflects a UK audience that is happy to browse on social platforms but reluctant to trust them for meaningful information, particularly around health, safety or ethics.

With upcoming regulatory scrutiny likely to shift toward influencer and creator content, brands need renewed clarity and guardrails around what social is for and what it is not.

Influencers are influential, but not on issues of trust

Despite the cultural power of creators, only:

- 5–6% want health or ingredient information from influencers

- 4% want environmental or ethical stories from creators

- 19% prefer influencer partnerships for broader brand inspiration

Influencer content performs best when the brief is cultural, emotional or lifestyle-driven, not when it asks consumers to make health or nutrition decisions.

This is also where the regulatory tension sits. Influencer promotions of “less healthy” products are now restricted under the LHF rules, even though consumers already ranked the channel low for these messages.

Brands should expect continued public pressure here, and smarter influencer strategies will be essential.

Storytelling wins when the story is brand-led, not product-led

When we asked which types of campaigns cut through most:

- 41% prefer campaigns about brand history or purpose

- 38% connect with community or sustainability stories

- Only 19% prioritise influencer/creator-led campaigns

- And 25% choose sponsorships

As LHF rules restrict product-level advertising, consumers are telling us exactly where the opportunity now sits:

Clear purpose. Real progress. Strong storytelling.

That’s what they remember and reward.

The Opportunity for Brands: Masterbranding and Storytelling in a Fragmented Landscape

The regulatory shifts coming in 2026 represent more than a compliance challenge - they mark a creative reset for food and drink brands. Success will depend not only on matching the message to the medium, but also on elevating masterbranding and the art of storytelling itself.

Our research points to a future where:

- Websites become the home of truth - the place for detailed, transparent stories about sustainability, ethics, and sourcing.

- Packaging remains the home of health - where nutritional clarity and functional benefits meet consumers at the point of decision.

- Social channels inspire, but don’t always convince - ideal for brand-led narratives, not for scientific authority.

- Creators and influencers shape culture, within limits - best used for emotional resonance, not factual persuasion

But the real differentiator is masterbranding: the ability to weave a compelling, consistent story that transcends individual products and channels. As product-level promotion becomes restricted, brands must lean into their purpose, values, and progress. Strong masterbranding ensures that every touchpoint - whether a website, a pack, or a social post - reinforces a unified narrative that builds trust and emotional connection.

Storytelling is no longer just about what you say or where you say it. It’s about how your brand’s story is crafted, shared, and remembered. Brands that invest in masterbranding and authentic storytelling will not only communicate better - they will define the next era of responsible, effective, and culturally relevant marketing.

To see every datapoint, chart, and recommendation shaping food marketing in 2026, download the full Consumer Navigator report.