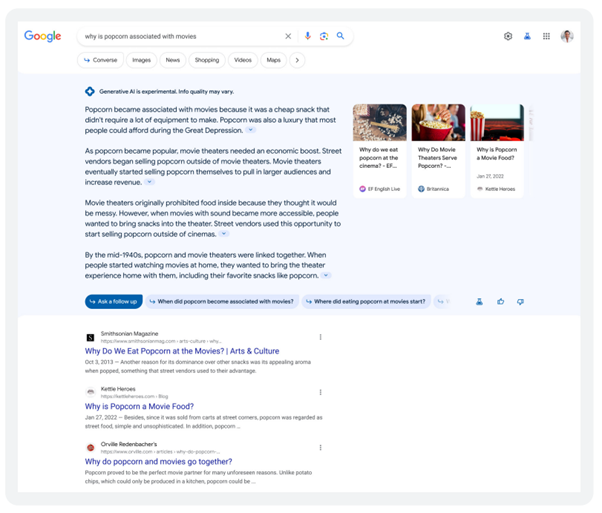

Google’s latest innovation in the world of search marks a significant evolution in the way that users will be able to interact with search results. Their new Search Generative Experience (SGE) will switch up the way that search engine results pages (SERPs) display content to users. Rather than static links, SGE will dynamically generate personal responses to individual queries. Essentially, SGE uses generative AI to conglomerate the most relevant SERP content into a single snippet at the top of the page. The implications look to be huge for organic discoverability, as it will kick-start a significant change in the search landscape. Fundamentally, SGE will change how users get their questions answered and how brands will be found through search engines. If you want to read more about specific changes for SEO, then take a look at this article.

So, how does it work?

Right now, SGE is still in the testing phase – so it’s not been rolled out fully in the UK. It’s an experimental update that uses artificial intelligence (AI) to provide personalised answers to user questions.

Google’s AI will analyse the SERP and create the best, unique solution to the user’s questions by creating a digestible answer at the top of the SERP in a snippet form, called the ‘AI spotlight’. From there, users can ask follow-up questions and interact with the AI. Sometimes, SGE might also provide a list of relevant features or products if the search is commercial based.

How is it Impacting Financial Services & What Can we do about it?

As expected, Google’s Search Generative Experience (SGE) feature will bring both new opportunities and challenges to financial brands operating in the digital space. There are still many uncertainties around how the SGE algorithm will operate, but the data so far suggests that its impact will vary greatly on different sectors. Although it’s clear that Google will continue to experiment and analyse user behaviour overtime, there are ways that financial services brands can prepare to shift their online strategies to make the most of SGE.

The bottom line is that SGE is going to bring about a very different search experience for users. The changing SERPs will likely lead to fluctuations in both paid and organic results - impacting rankings and traffic numbers. However, Google has stated that SGE isn’t supposed to answer user questions and send them on their way. They’ve said that their focus remains on continuing “sending valuable traffic to sites across the web”.

At Dentsu, we are working with our SEO tool suppliers – particularly keyword tracking tools – to help monitor the impact of any updates, and come up with a solution to allow us to eventually monitor personalised searches.

Conversational search intent will be key to success

Google’s SGE will undoubtedly reshape how financial institutions interact with clients and navigate the digital landscape. With the power to help democratise access to financial information and empower customers to make more informed decisions, SGE will help to provide more personal search results to the masses. The new feature will help to facilitate financial literacy -enhancing consumer understanding of more complex financial concepts. Therefore, those brands that produce content using language that customers can understand, across a wide range of products, will be the ones that benefit most from the SGE impacts. By continuing to prioritise many of the signals Google has previously put in place (such as Experience, Expertise, Authority & Trust or E-E-A-T), financial institutions should look to create content that helps to build credibility for their site.

How will SGE fuel customer engagement?

As many financial services brands already know, particularly in today’s digital age, it’s customer engagement that is crucial for those seeking to build long-lasting relationships with clients. Google’s SGE will offer a unique opportunity to enhance customer engagement through contextually relevant search results. Whether that’s specific financial advice, product recommendations or education resources - this content will be repurposed using AI-driven algorithms to directly impact search results. In turn, gaining greater visibility within the search engine results pages (SERPs) by feeding into this new ‘top spot’ will help deepen client relationships through trust building and increasing brand loyalty.

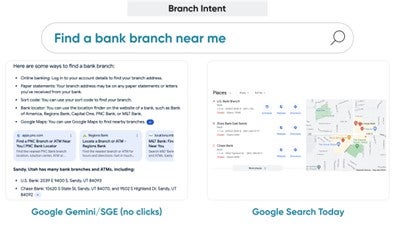

However, it’s likely that SGE will greatly impact organic traffic through prioritising AI-generated answers. As the AI snapshot will be the first thing that users see, it most likely will increase zero-click search results. The ‘old-style’ static links will still be there, just further down the page.

Navigating compliance in the financial world

According to data from BrightEdge, the global leader in organic search, content and digital marketing automation, new data has highlighted the impact of SGE on the finance industries will be the lowest of all the measured sectors. 17% of queries analysed were impacted by SGE within the finance industry compared to 49% in E-commerce and 30% in travel.

A major reason for this is because financial content falls into the Y-M-Y-L (Your Money Your Life) category, as consumer purchasing decisions in this sector will impact their financial circumstances. E-E-A-T principles are consequently crucial to content produced by financial businesses, as misinformation can cause harm to consumers.

Furthermore, financial services businesses operate within a highly regulated environment and are used to stringent compliance requirements. It’s therefore unsurprising that Google’s SGE will cause the finance sector to re-evaluate their regulatory frameworks in relation to safeguarding consumer data, as they aim to maintain trust and confidence with their customers.

Optimising marketing strategies as a financial business

Excitingly, Google’s SGE presents a new opportunity for financial institutions to optimise their marketing strategies to reach their audiences more effectively. By leveraging AI-powered algorithms to better understand user intent and preferences, financial businesses can better personalise their content to fit individual client needs.

With the capabilities to provide real-time financial insights, this new feature will empower customers to make more informed decisions about their finances – from managing budgets to planning major life events. Financial institutions can leverage SGE to offer value-added services, whether that be with financial planning tools or investment guides. These can then feed directly into search results, consequently enhancing the overall client experience.

Google’s new SGE feature encompasses a shift in how financial services will need to proposition themselves to be consumed in the digital age. By harnessing the power of these new AI-driven technologies, financial institutions can look to enhance customer engagement and empower their consumers through hyper-personal and easily digestible solutions to their queries. Prioritising consumer trust will remain critical as financial businesses seek to leverage Google’s latest updates more effectively. As Google continues to reshape the digital search landscape, embracing innovation and adopting a more customer-centric approach will be key to driving sustainable growth for the future.

If you need help with navigating this new world of search, then don’t hesitate to get in touch with our experts.